Any enquiries related to this publication should be sent to:

ILF Scotland Denholm House

Almondvale Business Park

Almondvale Way

Livingston

EH54 6GA

Phone: 0300 200 2022

Email: enquiries@ilf.scot

About us.......................................................................................................................................................................................3

Supporting our users A message from the Chair of the Board.................................................................................4

Introducing the people behind ILF Scotland...................................................................................................................6

Performance Report

Strategic Report Incorporating Management commentary......................................................................................11

Accountability Report

Statement of Directors’ Responsibilities.........................................................................................................................20

Remuneration and Staff Report for the year ended 31 March 2018......................................................................21

Annual Governance Statement for the year ended 31 March 2018......................................................................28

Directors’ Report for the year ended 31 March 2018..................................................................................................34

Independent Auditor’s Report to the members of ILF Scotland.............................................................................38

Financial Statements

Statement of Comprehensive Net Expenditure for the year ended 31 March 2018........................................42

Statement of Financial Position as at 31 March 2018.................................................................................................43

Statement of Cash Flows for the year ended 31 March 2018..................................................................................44

Statement of Changes in Taxpayers’ Equity for the year ended 31 March 2018...............................................45

Notes to the Accounts for the year ended 31 March 2018.......................................................................................46

The Independent Living Fund Scotland is a Public Body of the Scottish Government. Our role is to provide a high quality service to, currently, around 3,000 disabled people in Scotland and Northern Ireland, supporting them to achieve positive independent living outcomes, and to have greater choice and control over their lives.

ILF Scotland was established in July 2015. We work in partnership with 37 local authorities and health & social care trusts across Scotland and Northern Ireland by jointly funding individually tailored care and support packages.

Operating from our central office in Livingston we employ up to 43 dedicated people including our social care professionals. Our dedicated assessors visit our recipients in their own homes every two years to identify their needs often in conjunction with local authority social services departments.

Office address

ILF Scotland Denholm House

Almondvale Business Park Almondvale Way Livingston

EH54 6GA

Tel: 0300 200 2022

Email: enquiries@ILF.scot

Website: www.ilf.scot

ILF Scotland has had a second successful full year of operations, where we continued to make individual payments to disabled people, totalling almost

£50m. These payments continue to have life-changing significance forsome of Scotland and Northern Ireland’s most disabled citizens. Indeed, they tell us consistently about the positive impact of the fund on their ability to continue to lead active, engaged lives.

Much as ILF Scotland is pleased to continue to offer this financial support, we do not underestimate the significant challenges currently being faced by Scotland’s disabled people, including recipients of our fund. Our strategic plan sets out our key priorities for supporting ILF Scotland’s recipients, other disabled people, and carers, to overcome these challenges.

In December 2017 ILF Scotland opened a new small grants scheme for young disabled people. The criteria for this was determined through a process of co- production gathering the ideas from across our stakeholder groups in Scotland. As chair I would like to thank everyone involved in this as each of your contributions made an impact on how the new fund isbeing used. Over the course of next year I am excited to await stories of the impact these grants make on the lives of young disabled people who cannot easily access financial help to address issues of transition elsewhere.

As we at ILF implement our strategic plan, we remain fully committed to ensuring disabled people are at the heart of our organisation. It is imperative that we fully understand the implications of any decisions we make, or actions we take, on our current fund recipients and potential recipients of the new scheme. I am particularly pleased, therefore, that four of our seven Board Directors are disabled people, including myself, whilst 15% of our staff also identify as disabled people. In addition, we have convened independently chaired stakeholder groups of disabled people in both Northern Ireland and Scotland. I would like to express my sincere thanks to these groups for their time, commitment and expertise. They have already had a significant impact on the work of ILFScotland.

Last year I expressed my gratitude to the Scottish and Northern Ireland Government Sponsor teams for their continued support and interest in our work. My gratitude to these people continues through our partnerships with both the Scottish and Northern Irish Governments and our wider stakeholders.

Again this year, on behalf of the Board, I also want to recognise the hard work and achievements of the ILF Scotland staff team, evidenced by the many awards their hard work has led us to gain this year. To place this in context, let me remind you that ILF Scotland is a small and lean organisation. I love working with them and they continually achieve beyond my expectations.

The team is always focused on providing an exemplary service to existing recipients of the fund and most recently also to the new young recipients of our grant scheme. I, and the Board of Directors, appreciate the team’s hard work, and share their excitement and enthusiasm with them.

Finally, I would like to say thank you to my Board colleagues, in recognition of their contribution to our organisation and their support to me throughout the year.

Susan Douglas-Scott

Chair of the Board

Susan Douglas-Scott, Chair of the Board and member of the Remuneration Committee

Susan Douglas-Scott lives and works in Prestwick, Scotland. For the past eight years Susan has followed a diverse portfolio career as a freelance consultant in equalities, health, disability and social care, as a popular humanist celebrant and as a non-executive director with NHS Education for Scotland.

Her current roles followed on from an 18- year career in local authorities and non- Government Organisations in the field of disability and health, including the CEO of PHACE Scotland, CEO of Epilepsy Scotland and then the first CEO of the Health and Social Care Alliance.

In all her roles Susan uses her skills as a committed people person, holding strong foundations in supporting people to live their lives in a positive way. With over two decades in leadership of organisations Susan has given her experience and insight into how strategy and focusing on people can bring about effective change. Susan has a keen eye for organisational development and through that lens, guides organisations to deliver services that make a real difference to the people they serve.

Alan Dickson, Chair of the Audit & Risk Committee

Alan is a qualified accountant (Fellow Chartered and Certified Accountant) who has operated at a senior level within the public sector for most of his career. Alan was Head of Finance at the Student Loans Company for ten years and has worked in a variety of senior finance roles within local and central government. Alan was also previously the Chair of Good Morning Glasgow (a charity that delivers telephone befriending to older people) and was a Trustee of the Prince and Princess of Wales Hospice.

Fiona O’Donnell, Chair of the Remuneration Committee

Fiona O’Donnell is a qualified solicitor with a specialist accreditation in commercial mediation.

She has 37 years public sector experience with local government and the higher education sector in Aberdeen, Angus and Dundee and has worked part time as Company Secretary for the Legal Defence Union for 12 years.

Formerly Director of Legal at the University of Dundee, she worked with employment, discrimination and disability issues for both staff and students.

Fiona is now Honorary Fellow and Lead Mediator at the University and mediates regularly in the public, voluntary and business sectors as part of The Mediation Partnership.

She has been a Board Member of the Scottish Agricultural Wages Board for 8 years.

Elizabeth Humphreys Deputy Chair and member of the Audit & Risk Committee

Elizabeth has 30 years’ experience of working in the public and voluntary sectors. At Board level, in addition to her experience as Deputy Chair of ILF Scotland, she was a Director and Trustee of the Edinburgh-based charity IntoWork, which supports disabled people in finding employment. She is also a member of Changing the Chemistry, a Scottish charity with the aim of promoting diversity within organisations, particularly at Board level, and was an Independent Prison Monitor. During her career as a civil servant, Elizabeth championed the needs of disabled people and individuals with other protected characteristics through a wide variety of roles, securing improved services and support for both customers and staff.

Elizabeth McAtear, member of the Remuneration Committee

Elizabeth became involved in community development and the voluntary sector in the early 1980’s and was involved in the establishment of the Western Isles Citizens Advice Service, managing the local CAB for 25 years. She has also served as a local authority councillor and has served on the the Western Isles NHS Board.

She served on the Board of Management of Lews Castle College for eight years, the final two years as its Chair, in which capacity she also represented the College on the Board of Governors of the University of the Highlands and Islands (UHI). Elizabeth also served with Bord na Gàidhlig where she was Interim Chairman for a year in addition to chairing the Policy & Finance Committee.

Twimukye Macline Mushaka

Twimukye has been working with the Poverty Alliance in Glasgow as a Senior Fieldwork Development Officer since 2008. She has extensive experience of involvement with a range of third sector organisations in Scotland including on the Board of the Scottish Refugee Council (2008-2014), Member of the Board of Directors of One Parent Families (2013- 2017) and Bridging the Gap (2014-March 2017) Chair, Karibu Scotland Chair (2006

-2007 and member of the Board till 2017). She is currently on the Board of Deaf Blind Scotland and brings extensive knowledge of how disability impacts on independent living based on her own personal experience of living with multiple disabilities.

Bridget Sly, member of the Audit & Risk Committee

Bridget has over twenty-five years’ experience of working in the higher education, public and voluntary sectors in New Zealand and the UK as a practitioner, researcher, and policy-maker. She has lived experience as a disabled person and carer, and a commitment to equality and inclusive practice has permeated both her personal and working lives. She currently holds the post of Volunteer and Citizenship Manager with Glasgow Life, and was previously a non-Executive Director of the Glasgay festival and a lay advisor to the Metropolitan Police Service.

The SMT is responsible for the strategic management of ILF Scotland.

Peter Scott OBE, Chief Executive

Peter has over 20 years’ experience working in the voluntary and third sector, specifically in the area of disability. He began his career as a Support Worker in 1993 with a charity called Fair Deal. For the next 17 years, Peter undertook a number of managerial roles with various charities before becoming the Executive Director for Enable in 2008. In 2010, Peter then became Enable’s 6th CEO before moving to ILF Scotland in 2015.

Jim Maguire, Finance Director

Jim is a chartered accountant and has over 25 years’ experience operating at senior finance level. After over 20 years in the dairy sector, Jim moved to the public sector and his previous roles include finance director at the Scottish Police Services Authority and The Student Loans Company.

As Finance Director, Jim is responsible for all aspects of financial management and control within ILF Scotland, including close liaison with both internal and external audit.

Harvey Tilley, Chief Operating Officer

Although Harvey began his career in the British Army, he has spent the best part of the last 17 years working in the voluntary sector.

Specifically, this has been in the areas of homelessness, disability, care, grant giving and employability. Prior to taking up post as ILF Scotland’s Chief Operating Officer, the majority of roles he has held during this time have been leading large scale operations across the UK.

As Chief Operating Officer for ILF Scotland, Harvey not only deputises for the CEO, but is responsible for service delivery, IT, health and safety, information governance, facilities, human resources and organisational development. Harvey also acts in the capacity of company SIRO (Senior Information Risk Owner).

Paul Hayllor, Head of Corporate Planning and Development

Paul is a chartered HR professional with over 25 years management experience across government, health, education, defense, consultancy and the charitable sector. Key national projects have included introducing a new mental health service for Scottish veterans and launching a money advice and rights service.

Recently Paul has been more involved in IT projects and has led on the development of a new web based service to allow disabled young people to apply for grants to support their independent living.

Paul is responsible for the corporate planning and performance reporting, as well as the compliance requirements for Data Protection and Cyber Security.

Nadeem Hanif, Head of Finance

Nadeem has over 16 years’ experience in the financial and accountancy sector. After graduating in 2003, he began his career with HMRC, spending the next 9 years working in various finance and tax directorates. In 2012, he left HMRC to work for the Scottish Government as a Finance Manager before becoming ILF Scotland’s Head of Finance.

As Head of Finance, Nadeem has overall management of all day to day financial operations. This includes responsibility for the preparation of management accounts and management information.

Working closely with all other Heads of departments, ensuring appropriate and timely provision of management information and close management of organisational budgets.

Margaret Wheatley, Head of Policy

Margaret worked in Social Work Services for over 25 years, mainly in the field of disability, although in later years she specialised in the area of learning disability. Margaret became the Head of Learning Disability in East Glasgow Community Health and Care

Partnership (CHCP) before moving on to lead the initial development of Self Directed Support in Glasgow.

Prior to coming to ILF Scotland, Margaret worked for 3 years at Enable Scotland, in both their Service Delivery team and their Campaign team.

As ILF Scotland’s Head of Policy, Margaret is responsible for ensuring all policies and procedures deliver the organisation’s aims and that an excellent service is provided to recipients at all times.

Robert White, Head of Social Work

Robert has over 25 years of experience working in central and local government and has a keen interest in the interaction between social welfare and social work.

Robert began his career in the Department for Work and Pensions (DWP), undertaking various roles, from Benefits Officer to Social Fund Officer, before becoming a Social Worker, Mental Health Officer and Chair of a Practitioner forum in Ayrshire. Prior to starting with ILF Scotland in 2015, Robert managed a team of Social Workers in South Lanarkshire Council.

As Head of Social Work for ILF Scotland, Robert is responsible for managing and coordinating the organisation’s 22 Assessors who work across Scotland and Northern Ireland.

The Independent Living Fund Scotland was set up in 2015 and carries out the functions previously carried out by the Independent Living Fund (2006) within Scotland and Northern Ireland. Its aim is to deliver discretionary cash payments to disabled people, allowing them the choice and control to purchase personal support and live independent lives in their communities. The organisation is a Public Body of the Scottish Government (SG) and receives funding in the form of Grant in Aid from SG for Scotland. There is also an agreement between the Scottish Government and the Department of Health (DOH), Northern Ireland for ILF Scotland to administer ILF payments to ILF recipients based in Northern Ireland.

External auditor

Henderson Loggie

20 Greenmarket

Dundee

DD1 4QB

Solicitor

Central Legal Office

Breadalbane Street

Edinburgh

EH6 5JR

Internal auditor

TIAA Limited

Aerodrome Road

Gosport

PO13 0FQ

Banker

Royal Bank of Scotland

36 St. Andrew Square

Edinburgh

EH2 2

Following public advertisement and recruitment procedures in line with Scottish Government Public Appointments guidance directors have been appointed for a period of two years. At such time as the current Chair’s term of appointment ends or she resigns the Scottish Ministers under such guidance will also appoint the Chair. Directors’ appointments can be extended at the discretion of Scottish Ministers.

The Directors receive remuneration under arrangements agreed with the Scottish Government and are reimbursed for their incidental expenses in line with the company travel and subsistence policy.

Directors are appointed by the Scottish Ministers to administer ILF Scotland. Related parties are Directors, the Scottish Government (SG) and the Department of Health (DOH), Northern Ireland. There is an agreement between SG and DOH for ILF Scotland to administer ILF payments to ILF users based in Northern Ireland. ILF Scotland received Grant in Aid from SG of £52.3m (2016-17 £55.8m). SG makes payments to the company on a monthly basis. The Company’s ultimate controlling party is the Scottish Ministers.

Overview – In the last year, ILF Scotland has continued to deliver against the organisational strategy achieving a key milestone of successfully opening the Transition Fund in December 2017. Alongside this, the organisation has also been named as a Top 30 UK Employer by Working Families, the Best Public Sector Employer by Family Friendly Working Scotland and a winner in the Public Finance Innovation Awards.

Although the successful implementation of the Scottish Living Wage has been widely welcomed, it has put further pressure on the funding available for individuals especially when other increased employment costs are factored in. We continue to work closely with colleagues in the Scottish Government and Local Authorities to mitigate against the negative impact of a combination of financial pressures on independent living outcomes.

Key Operational Activities - Over this period the following key activities have taken place:

Strategic Priority 1 - The Existing Fund has been maximised for effective value:

Strategic Priority 2 - A New ILF scheme is successfully introduced and established in Scotland:

Strategic Priority 3 - The knowledge gained through our work across all of Scotland and Northern Ireland has been shared to develop best practice:

Main Effort - The key operational activities are outlined above, however the main effort has been to launch and run the Transition Fund alongside improving the 2015 Fund.

ILF Scotland Transition Fund – The ILF Scotland Transition Fund was launched to a controlled cohort of 500 people on 20th December 2017. This saw an application form either being sent to the applicant by post or available as an online form. Of note, the opening prior to the end of the 3rd quarter ensured that a Ministerial commitment was delivered and young disabled individuals in Scotland would have the opportunity to access this fund. ILF Scotland, Scottish Government colleagues and the Central Legal Services (CLO) from the NHS worked incredibly hard to achieve the sign off of a complete policy suite for the fund. On the technical side, the web service was tested and completed, but due to the findings from Digital First Assessment in October 2017, ILF Scotland decided it was necessary to undertake further work on this area to ensure successful implementation which is due to be completed in 2018/2019. In addition, the following work was carried out:

Recipients - What continues to be reinforced through all our activities and highlighted in previous reports, is the challenging time disabled people are experiencing in trying to have choice and control about decisions in their lives. The compound impact of the Scottish Living Wage, charging policies, the National Living Wage and increased employer related costs for both those that employ staff directly and use care providers, is significant and is reducing the amount of support available to individuals.

Scottish Living Wage Implementation – A major project was carried out in the first quarter including the automatic uplift of approximately 2,400 eligible recipients. Over the following quarters we have continued to work through any issues as a consequence of this, with the main one being individuals being pushed to the maximum award threshold. This has meant that additional visits have been required to review packages of around 200 individuals aiming to minimise the impact of increased costs of the number of hours of support.

Social work despite the significant pull on resources with the development and launch of the Transition Fund on Social work teams, we have moved into our second cycle of bi-annual reviews in Scotland and NI ahead of schedule. Work carried out in this reporting period has been aligned to the three strategic themes:

Policy – The Policy Team has continued to focus on promoting consistency in the application of policies in decision making, whilst also ensuring decisions are tailored to individual circumstances:

IT, Digital Transformation and Continuous Improvement – The Digital Transformation has continued on two fronts for ILF Scotland with the introduction of the new Transition Fund Web Service and our Cyber Catalyst role for Scottish Government. The back office systems have worked well to receive, process and evaluate the applications for the new fund, but the paper based approach has introduced time delays to processing which will not be an issue when the web service becomes live. The project team to deliver the technical solution has been increased and most of the work has focused on the upgrade of the infrastructure ready to deploy the new web service.

Finance – This has been another strong year from a financial perspective with another clean external audit, further strengthening of finance systems and being a winner in the Public Finance Innovation Awards . Other key achievements or activities of note are as follows:

Corporate Communications – Significant progress has been made in the area of corporate communications over this reporting period with a 97% increase in website views this year (25,997 in 2016/2017 compared to 51,147 in 2017/2018). There has also been a 105% increase in our online reach from 6,388 new users in 2016/2017 to 13,076 in 2017/2018. The Communications Team have largely focused on the implementation of ILF Scotland’s second key strategic objective of ‘Introducing and establishing a new ILF Scheme in Scotland’ (now known as the Transition Fund).

Specifically, the following activities have been undertaken and accomplished throughout the year:

People – During this year we have continued to strengthen our approach and systems relating to HR and organisational development, to ensure our employee proposition is inclusive, life friendly, market leading and skills appropriate. This also included finalising agreeing the pay structure with the Scottish Government. Of particular note ILF Scotland has become a Top 30 UK wide employer in the Working Families 2017 Benchmark and the Best Public Sector Employer at the 2018 Family Friendly Working Scotland Awards.

Summary – This has been another strong year, delivering further progress against our strategic plan with the launch of the new Transition Fund and improvements to the 2015 Fund. ILF Scotland’s Business Plan for 2018/2019 articulates the detailed priorities for the coming year.

The company is committed to good employee relations and HR policies have been developed from best practice to ensure full compliance with employment and equalities legislation.

ILF Scotland seeks to actively manage sickness absences and has return to work meetings with staff to improve support on resumption of duties and discuss absence patterns and causes.

The company procurement policy ensures fair competition and value for money, with specific arrangements to encourage tenders from employers of disabled people in procurement exercises. ILF Scotland is committed to prompt payment of bills for goods and services received. Payments are normally made within the period specified in the contract. Where there is no contractual or other understanding, we endeavour to pay within 10 days of the receipt of the goods or services, or the presentation of a valid invoice or similar demand, whichever is later. In 2017-18 ILF Scotland paid 97% of invoices within 10 days (2016-17 95%) of receipt. The number of creditor days outstanding at the end of 2017-18 was 15.2 days (2016-17 7.5 days).

We report an increase in taxpayers’ equity for the year amounting to £227,406 which has been transferred to general reserve as set out on page 45.

ILF Scotland is financed out of Grant in Aid from SG for the purpose of making regular grants to individuals. Grant in Aid of £52.3 million (2016-17 £55.8 million) was utilised in Scotland and Northern Ireland to meet the needs of users and related administration costs.

Assets are held only for the purpose of managing the company.

The company requests and receives Grant in Aid on a monthly basis to meet its immediate cash needs. Procurement policies are designed to secure goods and services for immediate consumption during the year with best value for money at current cost, and without setting up complex financial instruments. Company exposure to financial instrument risk is therefore low compared with non-public sector organisations. The policies on financial instruments are provided in the Notes to the Accounts, and appropriate disclosures are included.

Company law requires the Directors to prepare accounts for each financial year. The Directors have elected under the Companies Act to prepare the accounts in accordance with IFRSs as adopted by the EU and applicable law and to provide additional disclosures required by the Government Financial Reporting Manual 2017- 18 where these go beyond the requirements of the Companies Act 2006.

All financial and other matters necessary for an effective external audit have been disclosed to the auditors. As far as the Directors are aware there is no relevant audit information of which the auditors are unaware; the Directors have taken all the steps necessary to make themselves aware of any relevant audit information and to ensure that the auditors are aware of that information.

The accounts are prepared on a ‘going concern’ basis. Grant in Aid is received on a cash basis to meet immediate need. Grants to individuals are paid in arrears and the Statement of Financial Position at 31 March 2018 shows a surplus net assets position of £2,106,970 as set out on page 43.

SG has provided a letter to the Chief Executive to confirm that Grant in Aid will be made available to cover the financial obligations of the company for the financial year 2018-19.

There were no events after the end of the financial year that have any material effect on these Reports and Accounts.

The company provides estimates of expenditure to support the requests of Grant in Aid. Directors are required to take reasonable steps to ensure expenditure does not exceed available funding.

The company continues to develop a robust risk management programme, identifying major risks against business objectives and implementing appropriate risk management measures. The SMT reviews risks and reports to the Audit Committee and Board of Directors on a quarterly basis. Appropriate controls and action plans for risk management are put in place and these are reviewed at the risk management meetings. A separate Annual Governance Statement is provided in this document.

Signed by the Chair of the Board on behalf of the Directors on 25 June 2018.

Susan Douglas-Scott, Chair of the Board

The Directors are responsible for preparing the Strategic Report, the Directors Report and the accounts in accordance with applicable law and regulations.

Company law requires the Directors to prepare accounts for each financial year. The Directors have elected under the Companies Act to prepare the accounts in accordance with IFRSs as adopted by the EU and applicable law and to provide additional disclosures required by the Government Financial Reporting Manual 2017- 18 where these go beyond the requirements of the Companies Act 2006.

Under company law directors must not approve the accounts until they are satisfied that they give a true and fair view of the state of affairs of the company and of the profit or loss of the company for that period. In preparing these accounts the Directors are required to:

The Directors are responsible for keeping adequate accounting records that are sufficient to show and explain the company’s transactions and disclose with reasonable accuracy at any time the financial position of the company and enable them to ensure that the accounts comply with the Companies Act 2006. They have general responsibility for taking such steps as are reasonably open to them to safeguard the assets of the company and detect fraud and other irregularities.

The Directors have decided to prepare a Directors Remuneration Report in order to comply with the requirements of the Government Financial Reporting Manual 2017- 18 in accordance with Schedule 8 to the Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008 made under the Companies Act 2006, to the extent that they are relevant.

The Directors are responsible for the maintenance and integrity of the corporate and financial information included on the company’s website.

Signed by the Chair of the Board on behalf of the Directors on 25 June 2018.

Susan Douglas-Scott, Chair of the Board

Directors are appointed by Scottish Ministers for a period of two years which can be extended at the discretion of Scottish Ministers.

The Directors are appointed from a variety of backgrounds on the basis of relevant experience gained and relevant skills required.

The Chief Executive together with the Senior Management Team are responsible for day to day operations and activities.

Personal performance objectives for the Senior Management Team are currently being developed.

This report for the period ended 31 March 2018 deals with the remuneration of the Chief Executive, SMT and Directors of the Independent Living Fund Scotland.

ILF Scotland is managed by a Board of Directors appointed by Scottish Ministers. The Directors receive remuneration as post-holders and are reimbursed for incidental expenses in line with the company travel and subsistence policy. There are no unpaid persons or volunteers upon whose services the company is dependent.

The Remuneration Committee is appointed by the Board of Directors and is established to independently review the salary of the Chief Executive. The Chief Executive informs the Committee of any annual pay discussions to agree the salary levels for employees and SMT. The company complies with Scottish Government pay remit guidelines.

Members of the Committee for the period of this report were:

Fiona O’Donnell, Chair of the Remuneration Committee

Susan Douglas-Scott, Member of the Remuneration Committee

Elizabeth Humphreys, Member of the Remuneration Committee (Until 29 January 2018)

Elizabeth McAtear, Member of the Remuneration Committee (Appointed 29 January 2018)

The terms of reference of the Remuneration Committee in relation to salary, rewards and conditions of service are:

The following sections provide details of the remuneration and pension interests of the Directors and the most senior company management. The figures below form part of the Remuneration Report to be audited as referred to in the Audit Certificate.

For the year ended 31 March 2018 the total remuneration paid to Directors were:

| Name | 2017-18 | 2016-17 |

| £ | £ | |

| Susan Douglas-Scott (Chair) | 5,199 | 6,866 |

| Alan Dickson | 2,275 | 1,513 |

| Fiona O’Donnell | 1,004 | 1,169 |

| Bridget Sly | 2,028 | 1,229 |

| Elizabeth Humphreys | 3,066 | 1,706 |

| Elizabeth McAtear | 1,520 | 1,013 |

| Twimukye Macline Mushaka | 1,099 | 507 |

| Total | 16,191 | 14,003 |

In line with the company travel and subsistence policy a Director may also be reimbursed all reasonable and proper expenses incurred in carrying out their duties as a Director.

The Chief Executive and the SMT are employed on ILF Scotland terms and conditions.

The Directors have a policy regarding the senior management remuneration as follows:

The company is developing plans to have in place for the Chief Executive and the Senior Management Team, agreed objectives which are set by the Chairman of the Board of Directors and the Chief Executive respectively.

The Chief Executive’s and SMT performance will be reviewed annually with the overall assessment informed by quarterly one-to-one meetings.

In the event of early severance, compensation would be payable in accordance with company terms and conditions.

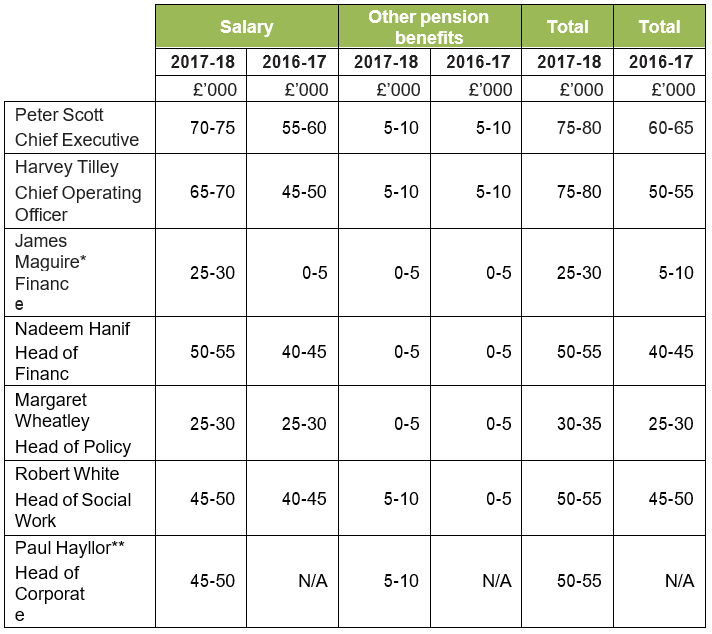

This table represents the part of the Remuneration Report to be audited as referred to in the Audit Certificate.

* James Maguire commenced employment in January 2017.

**Paul Hayllor joined the SMT on 1 April 2017.

There were no bonus payments arising during the period.

Both the company and employees contribute to a defined contribution stakeholder pension arrangement.

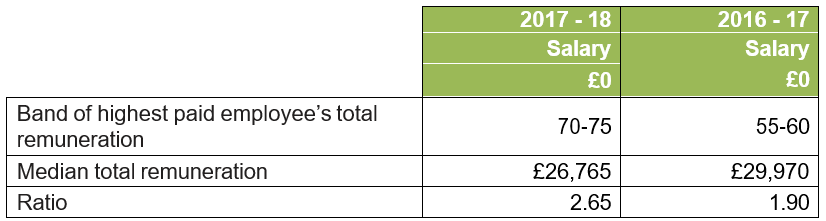

The banded remuneration of the highest paid employee in the company in the financial period 2017-18 was £70-75k (2016-17 £55-60k). This was 2.65 times (2016-17 1.82 times) the median remuneration of the workforce, which was £26,765 (2016-17 £29,970).

Total remuneration includes salary and benefits only. It does not include employer pension contributions.

The table above represents the part of the Remuneration Report to be audited as referred to in the Audit Certificate.

Pension benefits are provided through a defined contribution stakeholder scheme.

The employer makes a basic contribution of between 6% and 12% depending on the employee contribution. Employee contributions are salary-related and range between 2% and 5% of pensionable earnings.

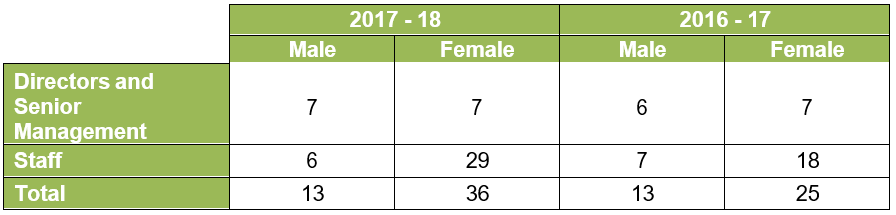

The table below shows the gender analysis of ILFS employees at 31 March.

The table below shows the staff absence analysis of ILFS employees for the year. Our absence rate falls within acceptable relevant comparable parameters. The current year includes two staff members on long-term sickness absence.

Our policy framework not only enables the delivery of our strategy but also supports the wishes, needs and aspirations of a modern workforce which is underpinned by a strong culture of trust, dignity and respect. This has not only helped ILF Scotland to be a beacon of independent living and innovative thinking for disabled people, but also an award-winning employer of choice. For us there is no such thing as a normal employee and the framework had to take into account values, equality, diversity, young and more mature employees, families, caring responsibilities and make-up of modern society . By doing this, we know we attract and retain the best team possible to achieve our inclusive organisational aspirations.

To support the way we aspire to work, we have co-produced with colleagues a comprehensive approach that supports our collective health and wellbeing. This methodology is solidly based on an Organisational Development strategy, tailored to support the culture of inclusiveness, diversity, outcomes focus, trust, coaching and continuous improvement. We have put in place a suite of life-friendly policies, procedures, benefits and systems that can be tailored to meet individual circumstances. This includes working flexibly, compressed hours, being sympathetic to individual/family emergencies or remote working and providing the right technology to do the job. We trust our staff to complete the work when they can around their agreed working hours and there is no expectation of taking work home or outside of hours working – unless it meets their needs.

Fiona O’Donnell, Remuneration Committee Chair

Signed by the above on 25 June 2018

The Board of Directors have responsibility for maintaining sound corporate governance systems that support the achievement of our policies, aims and objectives and safeguard the public funds and assets for which we are personally responsible.

Our responsibilities for managing public money and the duties assigned to us have been exercised with due diligence and the appropriate professional care.

The role of ILF Scotland is to deliver discretionary cash payments directly to disabled people, allowing them the choice and control to purchase personal support and live independent lives in their communities.

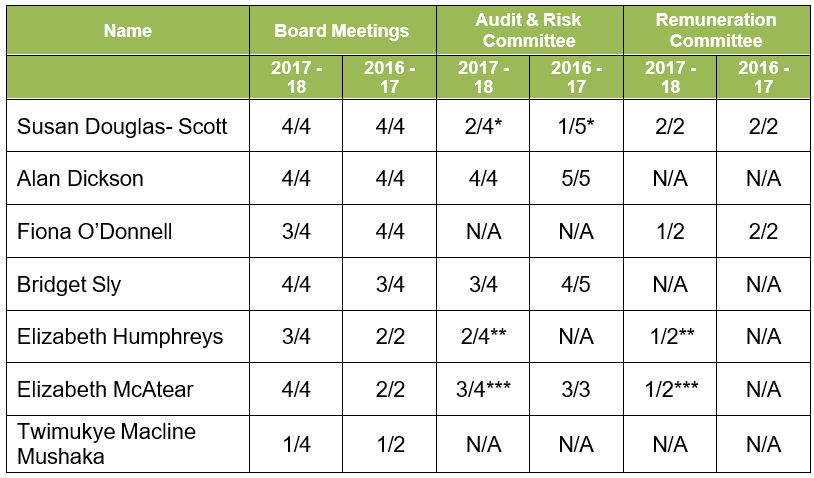

* Not a committee member. Attendance as an observer on occasion.

** Transferred from Remuneration Committee to Audit & Risk Committee in January 2018.

*** Transferred from Audit & Risk Committee to Remuneration Committee in January 2018.

As a relatively young company, our corporate governance systems continue to be drawn up from best practice recommendations and are being strengthened through internal scrutiny, legislative and process compliance and through collaborative working with both internal and external auditors.

These systems address individual and corporate accountabilities, the roles and effectiveness of our boards and our capacity to identify and effectively manage and report risk.

The company strategic aims and objectives have been developed by the Directors along with our sponsor team at the Scottish Government (SG). Our Chief Executive attends quarterly meetings chaired by SG officials. These meetings discuss significant business and programme risks and review ongoing progress against plan.

The programme meetings chaired by SG officials are supported by regular operational meetings with the sponsor team, members of specialist teams and other SG colleagues to ensure clarity of purpose, sound communication and effective reporting.

The Board met four times in formal session this period. There were also various board development days and committee meetings. All meetings have a pre-agreed agenda, are minuted and produced clear actions and matters arising. Meetings are attended by Directors and appropriate members of the SMT.

The Directors have a responsibility for maintaining sound systems of control to address key financial and other risks, ensuring that the requirements of the ILF Scotland founding documents are met, that high standards of corporate governance are demonstrated, and for reviewing the effectiveness of the systems of internal control.

The Chief Executive acts as the Risk Champion for the company, whilst lead responsibility for ensuring that appropriate mechanisms are in place for identifying, monitoring and controlling risk, and advising SMT on the actions needed in order to comply with our corporate governance requirements rests with the Chief Operating Officer, who also acts in the capacity of the ILF Scotland Senior Information Risk Owner (SIRO).

Our systems and processes are designed to manage risk to a reasonable and appropriate level rather than to eliminate all risk; therefore it can only provide reasonable and not absolute assurance of effectiveness.

Our Directors meet quarterly to address our strategic business priorities and the strategic risks associated whilst the SMT meets weekly.

Reviewing our strategic risks is a standing item at Board meetings, the SMT and the Audit & Risk Committee.

The Audit & Risk Committee provides a high-level resource that tests the adequacy of assurance on our risk management framework and internal control environment. The Audit & Risk Committee is attended by representatives of internal audit and, when appropriate, external audit.

Whilst every member of staff has a responsibility to ensure that exposure to risk is minimised, overall leadership of the risk management processes rests with members of the SMT.

The Risk Management Framework (RMF) sets out the organisation’s attitude to risk and provides a consistent basis to capture, monitor and report risks and to progress strategies to mitigate these. In assigning lead risk owners at SMT level and in the management control processes, we identify clear lines of responsibility throughout the organisation.

Our overall risk appetite is risk averse. This does not mean that we avoid opportunities to improve. However, it does mean that we are rightly cautious when challenges may hinder or put at risk our core business and service provision to our users.

Our risk management processes enable us to identify operational, business and financial risks, customer focus and delivery risks as well as identifying and assessing potential reputational risks and other contingent issues.

This year our emerging risks were mainly in connection with the setting up of the Transition Scheme which was launched late in 2017, the management of resources, the deployment of independent contractors and managing the movement of personal and sensitive information.

Our risks have been discussed within the organisation and where necessary we defined new roles and responsibilities, we introduced new measures, with improved management information and where appropriate attached a specific manager.

The managers’ role is to monitor, report on and manage these issues and risks. Although many of our risks hold a high inherent value at the outset, after controls and measures have been taken, they all hold a medium or low residual value.

Within our programme we have a significant challenge and risk involved in transferring sensitive user and confidential corporate data to our partners and client departments. This has required close liaison with relevant partners to ensure that we meet our legal responsibilities under the Data Protection Act. Data and information security has been managed as a high priority item.

In terms of data and information security breaches there have been none.

As Directors, we have responsibility for reviewing the effectiveness of the system of corporate governance, including systems of internal control. Our review is informed by the work of the SMT who has responsibility for development and maintenance of the internal control framework, and guided by advice from internal and external auditors.

We have been advised on the implications of my review of the effectiveness of the system of internal control by the SMT and the Audit & Risk Committee. As Chair of the Board I am confident that the Board of Directors and Audit & Risk Committee can draw significant assurance from the activity and reporting from SMT.

We also have in place independent internal auditors to examine our governance, risk management and control processes and they have provided their opinion that reasonable and effective governance, risk management and control processes were in place based upon their programme of work during the year.

The internal control systems SMT have put in place include:

The Board has been setting up its governance arrangements to ensure compliance with best practice and relevant legislation.

The Board has developed terms of reference for all boards and committees, including their purpose, membership, and the election of the lead Director as well as defining the management and reporting requirements for each internal function.

Our governance processes and mechanisms to manage our boards are consistently applied to capture discussions, actions, risks and progress. These provide a basis for consistent reporting and ease of read-across to inform recommendations, actions and outcomes, our boards include the SMT, the Audit & Risk Committee and the Remuneration Committee.

The SMT meets regularly and is responsible for ensuring that corporate risks are identified as early as possible, are properly managed, that cross-functional issues are considered, and that risk management receives a high profile in planning and delivery of our plans. The SMT along with some of our senior managers meets weekly to ensure that all attendees understand both the priorities of the week and any emerging issues.

The Audit & Risk Committee met four times during the period and is responsible for ensuring, as far as possible, that appropriate systems are in place within the company for the assessment and management of risk and advising the Board on the effectiveness of the systems of governance and control, leading to signing off the Annual Governance Statement.

The Audit & Risk Committee reviews Strategic Risks as a standing item, it routinely considers the effectiveness of payment security, fraud management and recovered and unspent monies, it reviews the internal audit plans to ensure sufficient rigor and detail and undertakes to provide a questioning and challenging role to obtain assurance.

The Remuneration Committee met twice during the year. It oversees and reports to the Directors on the salaries, rewards and conditions of service in place at the company. It also makes sure that ILF Scotland conducts its employee relations fairly, efficiently and effectively.

Internal controls and procedures have been further strengthened with a formal partnership with NHS Counter Fraud Services and the implementation of a continuous improvement plan following in depth internal review.

During the course of the year we have become aware of and have investigated three instances of suspected fraud in relation to fund recipients. The total amount estimated to be involved is up to £49,000 (2016-17 £75,000).

All cases have been reported to NHS Counter Fraud Services for investigation and two cases have been progressed to the Procurator Fiscal. As these payments were recorded as costs when originally advanced they do not represent a further cost if deemed to be irrecoverable.

Over the course of the year there has been no significant control weaknesses reported, nor has any report been made externally, independently nor via the company Whistle-blower policy.

Our audit and internal management reporting remains vigilant to ensure early identification of issues within normal day-to-day business and no significant issues have emerged.

We have managed our risks and highlighted issues with foresight and taken decisions as required; we have forecast and reported our financial position in a timely accurate manner and maintained our budget within expected parameters.

Whilst as a new organisation we continue to develop and improve our internal control and governance systems, in conclusion we believe that they were fit for purpose during the reporting period.

Susan Douglas-Scott

Chair of the Board

25 June 2018

The directors submit their annual report including for the year ended 31 March 2018.

The Directors have elected under the Companies Act to prepare the accounts in accordance with IFRSs as adopted by the EU and applicable law and to provide additional disclosures required by the Government Financial Reporting Manual 2017- 18 where these go beyond the requirements of the Companies Act 2006.

The principal activities are described on page 10.

Susan Douglas-Scott

Chair of the board

Alan Dickson

Non-executive director

Fiona O’Donnell

Non-executive director

Bridget Sly

Non-executive director (resigned 9 June 2018)

Elizabeth Humphreys

Non-executive director

Elizabeth McAtear

Non-executive director

Twimukye Macline Mushaka

Non-executive director

For further information, please see the Governance Statement on pages 28 to 33. All non-executive directors are considered to be independent.

None of the directors had any beneficial interest in the ownership of the company throughout the period. The company is guaranteed by the Scottish Ministers.

Full details of the movement in non-current assets are given in Notes 6 and 7 to the Accounts.

It is ILF Scotland’s aim to keep employees informed about its affairs and in particular those matters that affect them directly. The company regularly issues all-staff emails and is in the process of developing a staff Intranet site.

ILF Scotland is an Equal Opportunities Employer and actively encourages applications from disabled people.

The company contributes to a defined contribution stakeholder pension scheme to satisfy its obligations to staff.

There were no reportable Information losses in the period.

The Board is charged with maintaining a sound system of internal control that supports the achievement of the ILF Scotland policies, aims and objectives and regularly reviewing the effectiveness of that system. The Board is also responsible for the Governance Statement.

The Board’s Governance Statement is provided on pages 28 to 33.

The Board is responsible for ensuring that effective corporate governance arrangements are in place that set out how ILF Scotland is directed and controlled and how the assurance on risk management and internal control is provided.

The Board is required to demonstrate high standards of corporate governance at all times and to ensure that best practice is followed consistent with the UK Corporate Governance Code and appropriate adaptations of Corporate Governance in the Central Government Departments Code of Good Practice. The responsibilities of the Board are set out in the Governance Statement.

The remuneration for the Chair and Non-Executive Directors is determined by The Scottish Ministers. The remuneration of the Chief Executive is determined by the Board, subject to approval by The Scottish Ministers.

The Non-Executive Directors are appointed by The Scottish Ministers for a fixed term appointment of two years which can be extended at the discretion of The Scottish Ministers.

Members of the Committee are appointed by the Board. The Board determines the membership and terms of reference. The Chair of the Committee will report back to the Board after each meeting as required and the minutes of Committee meetings will be provided to Directors for information. Remuneration Committee meetings will normally be attended by the Chief Executive and the Chief Operating Officer.

For further information, please see the Remuneration Report on pages 21 to 25 and the Governance Statement on pages 28 to 33.

Members of the Committee are appointed by the Board. The Board determines the membership and terms of reference. The Chair of the Committee will report back to the Board after each meeting as required and the minutes of Committee meetings will be provided to Directors for information. Audit Committee meetings will normally be attended by the Chief Executive and the Chief Operating Officer.

Both external and internal audit have the right to independent access to the Chairman and members of the Committee.

Further details regarding the Audit & Risk Committee can be found in the Governance statement on pages 28 to 33.

The Directors who held office at the date of approval of the Directors’ Report confirm that, so far as they are each aware, there is no relevant audit information of which the External Auditor is unaware; and each Director has taken all steps that they ought to have taken as a Director to make themself aware of any relevant audit information and to establish that the External Auditor is aware of that information.

Details of all fees earned by the External Auditor are provided in note 5 of the annual accounts.

A resolution regarding the reappointment of Auditor to the Company was approved at the June 2018 Board meeting.

By order of the Board

James A Maguire Company Secretary 25 June 2018

Opinion

We have audited the financial statements of ILF Scotland for the year ended 31 March 2018 which comprise the Statement of Comprehensive Net Expenditure, the Statement of Financial Position, the Statement of Cash Flows, the Statement of Changes in Taxpayers’ Equity and the related notes, including a summary of significant accounting policies. The financial reporting framework that has been applied in their preparation is applicable law and International Financial Reporting Standards (IFRS) as adopted by the European Union and as applied in accordance with the provisions of the Companies Act 2006, and as interpreted and adapted by the 2017-18 Government Financial Reporting Manual (‘the 2017-18 FReM’).

In our opinion the financial statements:

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our responsibilities under those standards are further described in the Auditor's responsibilities for the audit of the financial statements section of our report. We are independent of the company in accordance with the ethical requirements that are relevant to our audit of the financial statements in the UK, including the FRC’s Ethical Standard, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Conclusions relating to going concern

We have nothing to report in respect of the following matters in relation to which the ISAs (UK) require us to report to you where:

Other information

The directors are responsible for the other information. The other information comprises the information included in the Annual Report, other than the financial statements and our auditor’s report thereon. Our opinion on the financial statements does not cover the other information and, except to the extent otherwise explicitly stated in our report, we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If we identify such material inconsistencies or apparent material misstatements, we are required to determine whether there is a material misstatement in the financial statements or a material misstatement of the other information. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact.

We have nothing to report in this regard.

Opinions on other matters prescribed by the Companies Act 2006

In our opinion, based on the work undertaken in the course of our audit:

Opinion on other matters prescribed by the 2017-18 FReM

In our opinion:

Matters on which we are required to report by exception

In the light of the knowledge and understanding of the company and its environment obtained in the course of the audit, we have not identified material misstatements in the Strategic Report or the Directors' Report.

We have nothing to report in respect of the following matters where the Companies Act 2006 requires us to report to you if, in our opinion

Responsibilities of directors

As explained more fully in the Statement of Directors' Responsibilities set out on page 20, the directors are responsible for the preparation of the financial statements and for being satisfied that they give a true and fair view, and for such internal control as the directors determine is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, the directors are responsible for assessing the company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the directors either intend to liquidate the company or to cease operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs (UK) will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements. We are also responsible for giving an opinion on the regularity of expenditure and income in accordance with the 2017-18 FReM.

A further description of our responsibilities for the audit of the financial statements is located on the Financial Reporting Council’s website at: http://www.frc.org.uk/auditorsresponsibilities. This description forms part of our auditor’s report.

This report is made solely to the company’s members, as a body, in accordance with Chapter 3 of Part 16 of the Companies Act 2006. Our audit work has been undertaken so that we might state to the company’s members those matters we are required to state to them in an auditor's report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the company and the company’s members as a body, for our audit work, for this report, or for the opinions we have formed.

Stephen Cartwright (Senior Statutory Auditor)

For and on behalf of

Henderson Loggie, Statutory Auditor Dundee

25 June 2018

| Expenditure | Notes | 2017-18 | 2016-17 |

| £ | £ | ||

| Grants to individuals | 3 | 49,780,857 | 52,386,656 |

| Staff costs | 4 | 1,435,148 | 1,086,888 |

| Depreciation and amortisation | 5 | 27,788 | 20,206 |

| Other expenditure | 5 | 686,627 | 737,684 |

| Total comprehensive net expenditure for the year | 51,930,420 | 54,231,434 |

The notes on pages 46 to 60 form part of these accounts.

All expenditure relates to continuing operations.

| Notes | 31 March 2018 | 31 March 2017 | |

| Non-current assets | £ | £ | |

| Property, plant and equipment | 6 | 5,533 | 18,060 |

| Intangible assets | 7 | 161,511 | 31,739 |

| Total non-current assets | 167,044 | 49,799 | |

| Current assets | |||

| Trade and other receivables | 9 | 86,691 | 41,025 |

| Cash and cash equivalents | 10 | 4,851,136 | 11,099,206 |

| Total current assets | 4,937,827 | 11,140,231 | |

| Total assets | 5,104,871 | 11,190,030 | |

| Current liabilities | |||

| Trade and other payables | 11 | (1,258,681) | (1,017,807) |

| Other liabilities – grant liabilities | 11 | (1,574,019) | (3,772,057) |

| Other liabilities – deferred income | 11 | (76,025) | (4,519,835) |

| Total current liabilities | (2,908,725) | (9,309,699) | |

| Total assets less current liabilities | 2,196,146 | 1,880,331 | |

| Non-current liabilities | |||

| Deferred income – capital grants | 12 | (89,176) | (767) |

| Net assets | 2,106,970 | 1,879,564 | |

| Taxpayers’ equity | |||

| General reserve | 2,106,970 | 1,879,564 | |

| Total taxpayers’ equity | 2,106,970 | 1,879,564 |

The notes on pages 46 to 60 form part of these accounts.

These accounts were approved and authorised for issue by the Directors on 25 June 2018.

Susan Douglas-Scott, Chair of the Board

| Notes | 2017-18 | 2016-17 | |

| Cash flows from operating activities | £ | £ | |

| Net expenditure | (51,930,420) | (54,231,434) | |

| Depreciation and amortisation | 5 | 42,827 | 22,506 |

| Amortisation of capital grant | 12 | (15,039) | (2,300) |

| (Increase)/Decrease in trade and other receivables | 9 | (45,666) | 41,256 |

| (Decrease)/Increase in trade and other payables, grant liabilities and provisions | 11/12 | (6,450,398) | 1,708,898 |

| Net cash outflow from operating activities | (58,398,696) | (52,461,074) | |

| Purchase of Fixed assets | 7 | (160,072) | (24,825) |

| Net cash outflow from investing activities | (160,072) | (24,825) | |

| Cash outflows from financing activities | |||

| Grant Funding | 52,157,826 | 55,823,318 | |

| Capital grant | 12 | 152,872 | |

| Net cash flows from financing activities | 52,310,698 | 55,823,318 | |

| Net (Decrease)/Increase in cash and cash equivalents in the period | (6,248,070) | 3,337,419 | |

| Cash and cash equivalents at the beginning of the period | 11,099,206 | 7,761,787 | |

| Cash and cash equivalents at the end of the period | 10 | 4,851,136 | 11,099,206 |

The notes on pages 46 to 60 form part of these accounts.

| General Reserve | ||

| £ | £ | |

| Balance at 1 April 2017 | 1,879,564 | |

| Changes in Taxpayers’ equity 2017-2018 | ||

| Grant in aid from departments | 52,157,826 | |

| Net expenditure | (51,930,420) | |

| 227,406 | ||

| Balance at 31 March 2018 | 2,106,970 | |

| Balance at 1 April 2016 | 255,182 | |

| Changes in Taxpayers’ equity 2016-2017 | ||

| Grant in aid from departments | 55,823,318 | |

| Net expenditure | (54,231,434) | |

| 1,591,884 | ||

| Add: Assets transferred from Scottish Government | 32,498 | |

| Balance at 31 March 2017 | 1,879,564 |

General reserve – relates to the ongoing operation of regular payments to individuals and the associated administration costs, financed by Grant in Aid.

Grant in Aid is not drawn in full in advance but requested each calendar month to meet estimated cash payments during the year.

Scottish Government has provided a letter of to the Chief Executive to confirm that Grant in Aid will be made available to cover the financial obligations of the company for the financial year 2018-19.

The notes on pages 46 to 60 form part of these accounts.

The Independent Living Fund Scotland commenced operations in July 2015. The company is limited by guarantee. The guarantor is The Scottish Ministers.

ILF Scotland carries out the functions previously carried out by the Independent Living Fund (2006) within Scotland and Northern Ireland. There is also an agreement between the Scottish Government and the Department of Health (DOH), Northern Ireland for ILF Scotland to administer ILF payments to ILF users based in Northern Ireland

It is financed by Grant in Aid from Scottish Government to provide assistance with the cost of qualifying support and services to disabled applicants and to meet the operating costs of the company. The Grant in Aid amount is approved annually and confirmed in a letter of delegation.

The Directors have elected under the Companies Act to prepare the accounts in accordance with IFRSs as adopted by the EU and applicable law and to provide additional disclosures required by the Government Financial Reporting Manual 2017- 18 where these go beyond the requirements of the Companies Act 2006.

The Accounts are prepared on a ‘going concern’ basis. Grant in Aid is received on a cash basis to meet immediate need. Grants to individuals are paid in arrears and the Statement of Financial Position at 31 March 2018 shows a net assets position.

Scottish Government has provided a letter of to the Chief Executive to confirm that Grant in Aid will be made available to cover the financial obligations of the company for the financial year 2018-19.

No amendment or interpretations have been issued but are not yet effective, and that are available for early adoption, have been applied by the company in these financial statements. There are no amendments or interpretations issued, but not yet effective, which are expected to have a material effect on the financial statements in the future.

a) Accounting convention

These accounts have been prepared under the historical cost convention modified for the revaluation of non-current assets.

b) Property, plant and equipment

Property, plant and equipment consists of IT equipment. ILF Scotland believes that the useful economic life is a realistic reflection of the life of its equipment, and the

depreciated historical cost method provides a realistic reflection of the consumption of those assets. The company therefore carries plant and equipment at cost less accumulated depreciation and any recognised impairment in value.

c) Depreciation

Depreciation on property, plant and equipment is charged on a straight-line basis to write off the cost less residual values over the useful life of the asset: incepting at the purchase date, or when the asset is available for use, whichever is the later. IT hardware and equipment is depreciated over a three-year life span.

Residual values, remaining useful lives and depreciation methods are reviewed annually and adjusted if appropriate.

d) Intangible assets

Intangible assets consist of bespoke software developed for the company and software licences held only for the purpose of managing the company. All intangible assets are carried at fair value.

Bespoke software assets are capitalised in these accounts in the year of implementation. Amortisation is on a straight line basis over the estimated useful life of three years.

Software licences are capitalised in these accounts in the year of acquisition. Amortisation is on a straight line basis over the estimated useful life.

Amortisation periods and methods are reviewed annually and adjusted if appropriate.

e) Financial instruments

The company procurement policy is to enter into contracts and framework agreements for services and supplies at current agreed costs with annual price reviews, rather than create complex financial instruments.

Financial assets and financial liabilities are recognised in the Statement of Financial Position when ILF Scotland becomes party to the contractual provisions of the instrument.

Financial assets and liabilities are recognised at fair value (the transaction price plus any directly attributable transaction costs, assessed for recoverability where relevant). Subsequent measurement is at amortised cost, although no adjustment for the time value of money is made where the settlement period is short so there would be no significant effect.

Financial assets comprise loans and receivables, which are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. Loans and receivables comprise cash at bank, accrued bank interest and other

receivables. Financial liabilities comprise grant liabilities, trade payables and accruals.

f) Reserves policy

Grant in Aid is not drawn in full in advance but requested each calendar month to meet estimated cash outflow. The company does not hold strategic reserves as it is dependent on public funding.

g) Grant in Aid

Funding to cover grants to individuals and administrative expenditure is provided through Grant in Aid from the Scottish Government. Grant in Aid is received on the basis of the ILF Scotland estimated cash payments during the financial year. Grant in Aid received forms part of the Departmental Expenditure Limits for the respective Departments. Grant in Aid is treated as financing rather than income and is directly credited to reserves.

h) Grants to individuals

Grants to individuals are discretionary grants made within Scottish Government rules and regulations. 2015 Fund grants are paid four weekly in arrears on the basis of authorised awards. Transition Fund grants are paid once applications have been approved and processed. Amounts due but unpaid at the end of the financial year are accrued in these accounts.

Unused grants returned by individuals in the normal course of business are recognised on receipt and there is no accrual for potential future returns of unspent grants.

i) Formal recovery of grants to individuals

Although grants to individuals are discretionary payments, formal recovery will be sought where the provision of incorrect information has led to incorrect payment or where the grants have not been used for the intended purpose. The company will seek to recover all amounts where it is cost-effective to do so unless it will cause hardship to the individual. Recovery procedures appropriate to the value and circumstances of the case will be used, in accordance with the ILFS guidelines and procedures.

In accounting for recoveries we have adhered to the Conceptual Framework for Financial Reporting which gives guidance that an asset should not be recognised in the statement of financial position when the expenditure has been incurred for which it is considered improbable that economic benefits will flow. Therefore, a receivable is only recognised in the accounts when it has been agreed with the individual and there is considered to be a reasonable prospect of recovery.

Any receivable recognised will be disclosed as a reduction to expenditure in the year in which it is recognised. Receivables will be assessed at the end of each accounting period and reduced to the estimated recoverable amount where there are circumstances that indicate full recovery is uncertain.

Operating leases

Operating leases are charged to the Statement of Comprehensive Net Expenditure on a straight line basis over the term of the lease. The main lease is for accommodation and managed facilities under a sub-lease with the Scottish Government. Charges are set in accordance with a head lease between the Department and the service provider.

The company has no direct control of these charges.

j) Pension costs

Both the company and staff contribute to a defined contribution pension scheme.

k) Significant estimates and judgements

The preparation of financial statements requires management to make estimates and assumptions in certain circumstances that affect reported amounts, and for this organisation such estimates are principally in assessing the recoverability of grants to individuals.

Where the estimated period of recovery of a grant is under 10 years, it is assumed that the full amount will be recovered. Where the period is over 10 years only the amount likely to be recovered within 10 years is included.

l) Reporting segments

IFRS 8 requires entities to provide information relating to the components of the entity that management uses to make decisions about operating matters. A segmental financial analysis is not considered necessary for the company, as no separate components are used for operating decisions made by the Senior Management Team.

m) Provisions

Provisions are recognised when there is a present obligation (legal or constructive) as a result of an event that occurred in the past and the settlement of that obligation will result in an outflow of resources, but the timing or amount of the settlement is uncertain. The amount recognised as a provision is the best estimate of the consideration which will be required to settle the obligation.

| 2017-18 | 2016-17 | |

| £ | £ | |

| Payments made in year | 53,154,783 | 51,582,664 |

| Grant liabilities at start of year | (3,772,057) | (2,204,381) |

| Grant liabilities at end of year | 1,574,019 | 3,772,057 |

| Grant prepayments at end of year | (43,276) | - |

| Grant returns received in year | (1,132,612) | (763,684) |

| 49,780,857 | 52,386,656 | |

| Number of individuals in receipt of payment at 31 March | 2,906 | 3,083 |

Grants to individuals are paid four-weekly in arrears. Grant liabilities consist of the accrued amounts from awards made by the end of the financial year but not fully paid up to the end of the financial year.

Returns received comprised £1,132,612 (2016-17 £763,684) in respect of unused funds returned by individuals.

| 2017-18 | 2016-17 | |

| £ | £ | |

| Wages and salaries | 1,195,723 | 917,724 |

| Social security costs | 114,048 | 79,355 |

| Other pension costs (see below) | 125,377 | 89,809 |

| Total staff costs | 1,435,148 | 1,086,888 |

| 2017-18 | 2016-17 | |

| Number | Number | |

| Average number of persons directly employed: | ||

| Directors (part-time non-executives) | 7 | 6 |

| Full time equivalent employees | 37 | 27 |

| 44 | 33 |

Employees can opt to contribute to a defined contribution pension account, a stakeholder pension with an employer contribution. Employer contributions range from 6% to 12% of pensionable pay. Employers match employee contributions up to 5% of pensionable pay.

Contributions due to the pension providers were nil at 31 March 2018 (31 March 2017 nil). Contributions prepaid were nil at 31 March 2018 (31 March 2017 nil).

| 2017-18 | 2016-17 | |

| Running costs: | £ | £ |

| Assessor fees and expenses | 148,313 | 221,760 |

| IT and information security costs | 149,063 | 136,646 |

| Rates, utilities and other estate costs | 125,840 | 100,226 |

| Legal and professional costs | 50,223 | 52,282 |

| Services, training, recruitment, travel and subsistence | 149,600 | 159,286 |

| Auditors remuneration (audit fee only) | 14,730 | 14,730 |

| Communication and engagement | 34,852 | 15,015 |

| Postage costs | 10,536 | 12,696 |

| Printing and stationary costs | 3,470 | 8,098 |

| Research costs | - | 16,945 |

| Total other expenditure | 686,627 | 737,684 |

| Non-cash items | ||

| Depreciation | 12,527 | 11,398 |

| Amortisation | 30,299 | 11,108 |

| Sub-total | 42,827 | 22,506 |

| Grant release | (15,039) | (2,300) |

| Total non-cash items | 27,788 | 20,206 |

| Information Technology | Total | |

| Cost | £ | £ |

| At 1 April 2017 | 37,583 | 37,583 |

| Additions in year | - | - |

| Balance at 31 March 2018 | 37,583 | 37,583 |

| Depreciation | ||

| At 1 April 2017 | 19,523 | 19,523 |

| Charge for year | 12,527 | 12,527 |

| Balance at 31 March 2018 | 32,050 | 32,050 |

| Net Book Value | ||

| At 31 March 2018 | 5,533 | 5,533 |

| At 31 March 2017 | 18,060 | 18,060 |

| Information Technology | Total | |

| Cost | £ | £ |

| At 1 April 2016 | 32,498 | 32,498 |

| Additions in year | 5,085 | 5,085 |

| Balance at 31 March 2017 | 37,583 | 37,583 |

| Depreciation | ||

| At 1 April 2016 | 8,125 | 8,125 |

| Charge for year | 11,398 | 11,398 |

| Balance at 31 March 2017 | 19,523 | 19,523 |

| Net Book Value | ||

| At 31 March 2017 | 18,060 | 18,060 |

| At 31 March 2016 | 24,373 | 24,373 |

| Cost or valuation | Information Technology | Total |

| £ | £ | |

| At 1 April 2017 | 46,080 | 46,080 |

| Additions in year | 160,072 | 160,072 |

| Balance at 31 March 2018 | 206,152 | 206,152 |

| Amortisation | ||

| At 1 April 2017 | 14,341 | 14,341 |

| Charge for year | 30,300 | 30,300 |

| At 31 March 2018 | 44,641 | 44,641 |

| Net Book Value | ||

| At 31 March 2018 | 161,511 | 161,511 |

| At 31 March 2017 | 31,739 | 31,739 |

| Cost or valuation | Information Technology | Total |

| £ | £ | |

| At 1 April 2016 | 26,340 | 26,340 |

| Additions in year | 19,740 | 19,740 |

| Balance at 31 March 2017 | 46,080 | 46,080 |

| Amortisation | ||

| At 1 April 2016 | 3,233 | 3,233 |

| Charge for year | 11,108 | 11,108 |

| At 31 March 2017 | 14,341 | 14,341 |

| Net Book Value | ||

| At 31 March 2017 | 31,739 | 31,739 |

| At 31 March 2016 | 23,107 | 23,107 |

Intangible assets mainly comprise bespoke software and software licences. There is no significant difference between historic cost and fair value.

As all of the majority of the company’s cash requirements are met through Grant in Aid, financial instruments play a more limited role in creating and managing risk than would apply to a non-public sector body. The majority of financial instruments relate to contracts to purchase non-financial items in line with the company’s expected usage requirements, so the company is exposed to little credit, liquidity or market risk. The value of financial instruments are considered to be a proxy of their fair value.

| 31 March 2018 | 31 March 2017 | |

| £ | £ | |

| Cash and cash equivalents | 4,851,136 | 11,099,206 |