Any enquiries related to this publication should be sent to:

ILF Scotland Denholm House

Almondvale Business Park

Almondvale Way

Livingston

EH54 6GA

Phone: 0300 200 2022

Email: enquiries@ilf.scot

About us.....................................................................................................................................................................................3

Supporting our users A message from the Chair of the Board...............................................................................4

Introducing the people behind ILF Scotland................................................................................................................6

Performance Report

Strategic Report Incorporating Management commentary...................................................................................11

Accountability Report

Statement of Directors’ Responsibilities...................................................................................................................... 26

Remuneration and Staff Report for the year ended 31 March 2019....................................................................27

Annual Governance Statement for the year ended 31 March 2019....................................................................34

Directors’ Report for the year ended 31 March 2019...............................................................................................40

Independent Auditor’s Report to the members of ILF Scotland..........................................................................44

Financial Statements

Statement of Comprehensive Net Expenditure for the year ended 31 March 2019.....................................48

Statement of Financial Position as at 31 March 2019...............................................................................................49

Statement of Cash Flows for the year ended 31 March 2019................................................................................50

Statement of Changes in Taxpayers’ Equity for the year ended 31 March 2019..............................................51

Notes to the Accounts for the year ended 31 March 2019.....................................................................................52

The Independent Living Fund Scotland is a Public Body of the Scottish Government. Our role is to provide a high quality service to, currently, around 3,500 disabled people in Scotland and Northern Ireland, supporting them to achieve positive independent living outcomes, and to have greater choice and control over their lives.

ILF Scotland was established in July 2015. We work in partnership with 37 local authorities and health & social care trusts across Scotland and Northern Ireland by jointly funding individually tailored care and support packages.

Operating from our central office in Livingston we employ up to 45 dedicated people including our social care professionals. Our assessors visit our recipients in their own homes every two years to identify their needs often in conjunction with local authority social services departments.

Office address

ILF Scotland Denholm House

Almondvale Business Park

Almondvale Way

Livingston

EH54 6GA

Tel: 0300 200 2022

Email: enquiries@ILF.scot

Website: www.ilf.scot

As ILF Scotland approaches its fourth birthday, I am immensely proud of the achievements and success of our young organisation.

ILF Scotland was created by the Scottish Government to safeguard the vital support that ILF has provided to severely disabled people since 1988. Arguably, this support has never been more important than it is today. Disabled people tell me that, in many ways, the barriers to independent living are increasing rather than being overcome.

The ILF provides life-enhancing opportunities for its recipients to overcome these barriers, at least in part, allowing them to participate in, and contribute to, their communities and our society, in ways that would not otherwise be available to them. We are all enriched as a result.

However, our Fund recipients also tell me that they are unhappy that more people who are just as significantly disabled as they are cannot access ILF and enjoy the same benefits as they do. The Fund was closed to new applicants by the Department for Work and Pensions (DWP) in 2010, and therefore many disabled people are missing out on the life-transforming potential of the Fund. This is a frustration to our disabled partners, and to me.

I am pleased that, following on from the Scottish Government’s commitment, made in the 2018-19 Programme for Government “Delivering for today, investing for tomorrow”, there is an intention to “gather views and consider evidence for a potential new national scheme to provide extra financial support to people with the highest social care needs”. I believe that, with further development of our existing model, ILF Scotland is well placed to deliver such a scheme, building on our success and strong reputation amongst disabled people.

Our Northern Ireland Stakeholder Group has been very proactive in raising the profile of ILF amongst key decision makers and, jointly with their Scottish counterparts, held a recent event in Stormont’s Parliament Buildings. The outcome from this event has been a commitment from the Northern Ireland Department of Health to do some preparatory work, looking at the merits and feasibility of re-opening ILF. Again, I am delighted at this prospect, and all of us at ILF Scotland stand ready to help in any way we can. I would like to extend my appreciation to our Stakeholder Groups for making this event such a success, and for their wider, invaluable contribution to the success of our organisation.

The new ILF Scotland Transition Fund was first opened to applicants in December 2017. The first payments were made in April 2018, and we are now at the end of the first full annual cycle of grant payments. Although still in its infancy, early indications, both from our own evidence gathering and through independent research carried out by Glasgow University’s Strathclyde Disability Research Centre, point to significant, life transforming, outcomes for young disabled people across Scotland. We look forward to receiving the full report from Strathclyde Disability Research Centre, and using this evaluation to inform further developments with the Transition Fund.

In previous years, I have expressed my gratitude to the Scottish and Northern Ireland Government Sponsor teams for their continued support and interest in our work, and my gratitude to these people continues. On behalf of the Board, I again want to recognise the hard work and achievements of the ILF Scotland staff team, evidenced by the many awards their hard work has led us to gain this year. To place this in context, let me remind you that ILF Scotland is a small and lean organisation. I love working with them and they continually achieve beyond my expectations.

The team is always focused on providing an exemplary service to existing recipients of the fund and most recently also to the new young recipients of our grant scheme. I, and the Board of Directors, appreciate the team’s hard work, and share their excitement and enthusiasm.

Finally, I would like to say thank you to my Board colleagues, in recognition of their contribution to our organisation and their support to me throughout the year.

Susan Douglas-Scott CBE Chair of the Board

Susan Douglas-Scott, Chair of the Board and member of the Remuneration Committee

Susan Douglas-Scott lives and works in Prestwick, Scotland. For the past nine years Susan has followed a diverse portfolio career as a freelance consultant in equalities, health, disability and social care, as a popular humanist celebrant and as a non- executive director with NHS Education for Scotland (NES)

In April 2018 Susan was delighted to be appointed as Chair of NHS Golden Jubilee Foundation which worked well as her term with NES ended in May the same year.

At ILF Scotland Susan relishes the opportunity it gives her to help enable disabled people to live the lives of their choice. Susan is delighted the way ILF Scotland has developed as an organisation over the last four years and is especially pleased that it can showcase its excellent progress having won multiple awards including ones for being positive employers and for excellence from the finance team.

Susan enjoyed an 18 year career in local authorities and non-Government Organisations in the field of disability and health, including the CEO of PHACE Scotland, CEO of Epilepsy

Scotland and then the first CEO of the Health and Social Care Alliance.

In 2008 Susan was lead author of “Gaun Yersel” the Scottish

Government’s self-management strategy for people living with long term conditions. This year this strategy celebrated its 10th anniversary and Susan was invited to speak at an event where the Cabinet Secretary for Health and Sport gave a keynote speech outlining its continued relevance on today’s health and social care landscape.

In all her roles Susan uses her skills as a committed people person, holding strong foundations in supporting people to live their lives in a positive way. Susan has a keen eye for organisational development and through that lens, guides organisations to deliver services that make a real difference to the people they serve.

Susan is very proud that ILF Scotland has a positive staff and recipient index of worth and will continue to give her full support.

Susan was honoured that her work over the years was recognised by being awarded a CBE in the Queen’s 2019 New Year honours list for services towards improving Human Rights in relation to Disability and LGBT.

Alan Dickson, Chair of the Audit & Risk Committee

Alan is a qualified accountant (Fellow Chartered and Certified Accountant) who has operated at a senior level within the public sector for most of his career. Alan was Head of Finance at the Student Loans Company for ten years and has worked in a variety of senior finance roles within local and central government. Alan was also previously the Chair of Good Morning Glasgow (a charity that delivers telephone befriending to older people) and was a Trustee of the Prince and Princess of Wales Hospice.

Fiona O’Donnell, Chair of the Remuneration Committee

Fiona O’Donnell is a qualified solicitor with a specialist accreditation in commercial mediation.

She has 38 years public sector experience with local government and the higher education sector in Aberdeen, Angus and Dundee and has worked part time as Company Secretary for the Legal Defence Union for 13 years.

As Director of Legal at the University of Dundee, she worked with employment, discrimination and disability issues for both staff and students and set up the early dispute and mediation service at the University 10 years ago.

Having retired, Fiona is now Honorary Fellow at the University and mediates regularly in the public, voluntary and business sectors to help individuals and groups overcome disputes and reach better understandings by engaging in mediation.

Elizabeth Humphreys Deputy Chair and member of the Audit & Risk Committee

Elizabeth has 30 years’ experience of working in the public and voluntary sectors. At Board level, in addition to her experience as Deputy Chair of ILF Scotland, she is Chair of Drake Music Scotland, Scotland’s leading music and disability organisation.

She is also a member of Changing the Chemistry, a Scottish charity with the aim of promoting diversity within organisations, particularly at Board level, and was an Independent Prison Monitor.

During her career as a civil servant, Elizabeth championed the needs of disabled people and individuals with other protected characteristics through a wide variety of roles, securing improved services and support for both customers and staff.

Elizabeth McAtear, member of the Remuneration Committee

Elizabeth worked mostly in the third sector with involvement in community development for over 30 years, the main achievement of which was the establishment of the Western Isles Citizens Advice Service in 1988.

Thereafter she managed the local CAB for 25 years.

She further developed her voluntary work in the community through participation in public services, gaining knowledge and experience of service provision across Local Government, the Health Service, housing, and education from primary through to Higher and University level. She acquired a very broad range of skills and experience, including governance, strategic planning, financial control monitoring and the ability to challenge constructively at Board level, all of which she brings to her role on the Board of ILF Scotland.

In addition to caring for her disabled husband Elizabeth tutors Gaelic language on a part-time basis at Lews Castle College, UHI. She is also currently Treasurer of the Barra Access Panel which feeds into the national body from a remote island perspective.

Mark Adderley member of the Audit & Risk Committee

Mark is an experienced executive and non-executive director with a passion for equality and social justice. He has over 20 years’ experience in change, transformation, HR and people skills with executive roles in utilities, NHS, Higher Education and not for profit activity. Mark is also a Chartered Director and fellow of IOD and CIPD and brings his experience of governance and passion for people to the board.

The SMT is responsible for the strategic management of ILF Scotland.

Peter Scott OBE, Chief Executive

Peter has over 20 years’ experience working in the voluntary and third sector, specifically in the area of disability. He began his career as a Support Worker in 1993 with a charity called Fair Deal. For the next 17 years, Peter undertook a number of managerial roles with various charities before becoming the Executive Director for Enable in 2008. In 2010, Peter then became Enable’s 6th CEO before moving to ILF Scotland in 2015.

Jim Maguire, Finance Director

Jim is a chartered accountant and has over 30 years’ experience operating at senior finance level. After over 20 years in the dairy sector, Jim moved to the public sector and his previous roles include finance director at the Scottish Police Services Authority and The Student Loans Company.

As Finance Director, Jim is responsible for all aspects of financial management and control within ILF Scotland, including close liaison with both internal and external audit.

Harvey Tilley, Chief Operating Officer

Although Harvey began his career in the British Army, he has spent the best part of the last 18 years working in the voluntary and public sector.

Specifically, this has been in the areas of homelessness, disability, care, grant giving and employability. Prior to taking up post as ILF Scotland’s Chief Operating Officer, the majority of roles he has held during this time have been leading large scale operations across the UK.

As Chief Operating Officer for ILF Scotland, Harvey not only deputises for the CEO, but is responsible for service delivery, IT, health and safety, information governance, facilities, human resources and organisational development. Harvey also acts in the capacity of company SIRO (Senior Information Risk Owner).

Paul Hayllor, Head of Corporate Planning and Development

Paul is a chartered HR professional with over 25 years management experience across government, health, education, defence, consultancy and the charitable sector. Key national projects have included introducing a new mental health service for Scottish veterans and launching a money advice and rights service.

Recently Paul has been more involved in IT projects and has led on the development of a new web based service to allow disabled young people to apply for grants to support their independent living.

Paul is responsible for the corporate planning and performance reporting, as well as the compliance requirements for Data Protection and Cyber Security.

Nadeem Hanif, Head of Finance

Nadeem has over 17 years’ experience in the financial and accountancy sector. After graduating in 2003, he began his career with HMRC, spending the next 9 years working in various finance and tax directorates. In 2012, he left HMRC to work for the Scottish Government as a Finance Manager before becoming ILF Scotland’s Head of Finance.

As Head of Finance, Nadeem has overall management of all day to day financial operations. This includes responsibility for the preparation of management accounts and management information.

Working closely with all other Heads of departments, ensuring appropriate and timely provision of management information and close management of organisational budgets.

Linda Scott, Head of Policy

Linda is responsible for leading the Policy function within ILF Scotland. She joined in August 2018 after working in Health & Social Care Integration for just over three years.

She has spent her career of more than 30 years in the public sector, primarily in social housing and has held managerial positions in both local and Scottish Government. Her expertise includes Policy, Strategy, Planning, Project Management, Operational Management, Service Improvement, Regulation Management and Governance having held positions previously as a non-executive board member.

Robert White, Head of Social Work

Robert has over 25 years of experience working in central and local government and has a keen interest in the interaction between social welfare and social work.

Robert began his career in the Department for Work and Pensions (DWP), undertaking various roles, from Benefits Officer to Social Fund Officer, before becoming a Social Worker, Mental Health Officer and Chair of a Practitioner forum in Ayrshire. Prior to starting with ILF Scotland in 2015, Robert managed a team of Social Workers in South Lanarkshire Council.

As Head of Social Work for ILF Scotland, Robert is responsible for managing and coordinating the organisation’s 22 Assessors who work across Scotland and Northern Ireland.

The Independent Living Fund Scotland was set up in 2015 and carries out the functions previously carried out by the Independent Living Fund (2006) within Scotland and Northern Ireland. Its aim is to deliver discretionary cash payments to disabled people, allowing them the choice and control to purchase personal support and live independent lives in their communities. The organisation became a Non- Departmental Public Body of the Scottish Government (SG) in June 2018 (having previously been an Other Significant Public Body) and receives funding in the form of Grant in Aid from SG for Scotland. There is also an agreement between the Scottish Government and the Department of Health (DOH), Northern Ireland for ILF Scotland to administer ILF payments to ILF recipients based in Northern Ireland.

External auditor

MHA Henderson Loggie 20 Greenmarket

Dundee

DD1 4QB

Solicitor

Central Legal Office

Breadalbane Street

Edinburgh

EH6 5JR

Internal auditor

TIAA Limited Aerodrome Road

Gosport

PO13 0FQ

Banker

Royal Bank of Scotland

36 St. Andrew Square

Edinburgh

EH2 2AD

Following public advertisement and recruitment procedures in line with Scottish Government Public Appointments guidance directors are appointed on a fixed term basis. At such time as the current Chair’s term of appointment ends or she resigns the Scottish Ministers under such guidance will also appoint the Chair. Directors’ appointments can be extended at the discretion of Scottish Ministers.

The Directors receive remuneration under arrangements agreed with the Scottish Government and are reimbursed for their incidental expenses in line with the company travel and subsistence policy.

Directors are appointed by the Scottish Ministers to administer ILF Scotland. Related parties are Directors, the Scottish Government (SG) and the Department of Health (DOH), Northern Ireland. There is an agreement between SG and DOH for ILF Scotland to administer ILF payments to ILF users based in Northern Ireland. ILF Scotland received Grant in Aid from SG of £53.3m (2017-18 £52.3m). SG makes payments to the company on a monthly basis. The Company’s ultimate controlling party is the Scottish Ministers.

Overview

ILF Scotland is now approaching the end of our first 3 year strategy, and we are pleased to report strong progress against our three key strategic themes: -

As well as achieving, ahead of schedule, the majority of our strategic objectives set in 2016, we have fully established our identity and credibility to support those disabled individuals with the most complex needs and circumstances in Scotland and Northern Ireland, whilst delivering the first stage of the new Transition Fund for young disabled people in Scotland.

This has been achieved against a backdrop of significant change in the policy and practice of health and social care and an austere financial climate. As our numbers grow in the Transition Fund and we look to increase our services to our 2015 Fund recipients, we are excited to start the process of developing our new strategy and strategic partnerships in 2019/20, to make independent living a reality for even more disabled people living in Scotland and Northern Ireland.

In the last year, ILF Scotland has continued to deliver against the organisational strategy. Our main activities have included: the successful implementation of key policy changes; a Northern Ireland cost of living uplift; a reduction in recipient financial contributions; a Scottish Living Wage (SLW) uplift; overnight hours adjustments for SLW; growth of the new Transition Fund; and the organisation supporting the first joint stakeholder meeting and event held in Northern Ireland. All of these developments are making a real and positive impact on thousands of disabled people and their families across Scotland and Northern Ireland.

To support this work, we have endeavoured to develop our technical capabilities through a comprehensive programme of improvement including a new technical capabilities and online functionality, whilst investing in our skills and knowledge to improve outcomes for disabled people. These new capabilities represent a real paradigm shift in the way we administer the Funds, allowing, for example, multiple interventions for 2015 fund recipients and online applications for the Transition Fund. ILF recipients get timely and high quality support, ensuring that they are at the centre of what ILF Scotland does.

Alongside this, significant organisational effort has gone into increasing the operational tempo around the applications and awareness of the Transition Fund, including our highly successful campaign launch of #TrySomethingNew. This has resulted in strong growth in applications received throughout the year, seeing a 44% jump in Qtr 4 alone. We are also delighted to report that we have launched our first online service co-designed by young disabled individuals to make the application process simpler for the Transition Fund, which has now seen over 100 requests for online accounts in the last three months of the reporting period.

As a consequence of the aforementioned work, we have had our busiest year operationally with 2015 Fund and Transition Fund visits, reports, applications and offers. Though we have spent considerable time improving internal process and had a small uplift in frontline staff, the numerous efficiencies and limited staffing increases are now being outstripped by the complexity and volume of administration of both funds.

To put this into perspective, in our first fully operational year 2016/17 we carried out just over 2,000 key enabling interventions. This year we carried out over 5,000 - an increase of 250%.

Finally, in the past year, the organisation has been proudly recognised as a Best Small UK Employer at the Working Families 2018 Special Awards, the Best Finance Team in the 2018 CIPFA UK Finance Awards, Top 10 UK Employer by Working Families and we were a finalist alongside our marketing partner in the Edinburgh Chamber of Commerce Business Awards in the Digital Marketing category. This external recognition has been due to the hard work and professionalism of our staff, who always go the extra mile to make a real positive impact for disabled people in Scotland and Northern Ireland. This is backed up by feedback reporting satisfaction from the 2015 recipients of 98% and in our first year of operations in relation to the Transition Fund, recipients report 97.5% satisfaction. This not only shows we are delivering high quality services but that these services are greatly valued by disabled people.

Key Operational Activities - Over the past year the following key activities have taken place:

Strategic Priority 1 - The Existing Fund has been maximised for effective value:

Strategic Priority 2 - A New ILF scheme is successfully introduced and established in Scotland:

Strategic Priority 3 - The knowledge gained through our work across all of Scotland and Northern Ireland has been shared to develop best practice:

Policy Revision - We have completed the following in this reporting period:

Recipient Feedback - Based on 159 surveys received, over 98% of recipients reported satisfaction with their service from ILF Scotland. This is the same as last year but is based on a higher response rate and, although positive, we hope to get an even richer sample when our new online survey is fully rolled out in 2019/20.

Scottish Living Wage (SLW) Implementation – in line with Scottish Government policy we have implemented the May 2018 SLW increment. This proved to be slightly more straightforward following the learning from previous uplifts, coupled with additional systems development. That said, this was still a highly complex task which requires significant work to ensure all recipients can benefit from the Scottish government’s policy intent.

We also took a different approach with provider agencies this year, as the blanket uplift approach used previously caused confusion and anxiety for some fund recipients. It also generated significant amounts of unspent money in recipients’ bank accounts, which are now being returned to ILF Scotland. Therefore, as the annual SLW increase moves to normal business activity, we will not be applying blanket uplifts for providers going forward, but will manage things through ILF Award Managers and Assessors on a case by case basis.

This approach has been agreed with Scottish Government, and we will monitor this to ensure it is working for all. One further variation this year also saw a policy change that enabled us to exceed the maximum award to facilitate the SLW uplift which meant that every Scottish recipient was to benefit from the uplift. The new SLW increased to £9.00 per hour effective from 1 April 2019.

We applied this on this date to all of our recipients employing PAs, and are applying it on a case by case basis to those using agencies. For the first time, overnight hours are now paid at the SLW rate, which has added significant additional complexity to the implementation process.

The transition to adult life is known to be a particularly challenging time for many young disabled people and their families in Scotland. It was not surprising therefore that, through our co-production work, ILF Scotland was asked to prioritise this area of work as we developed our new fund. We are pleased to report that, over the course of the last year, the fund has become firmly established, with growing awareness among key partners. Most importantly, we are beginning to learn about the life-transforming impact the fund is having for so many young disabled people as they navigate from school to adult life.

Since the launch of the Transition Fund in late December 2017, there has been continued steady growth in the number of applications received. Over the past 12 months we have seen the following numbers of applications:

This steady growth clearly shows a positive direction of travel, demonstrating that all of the hard work carried out to grow awareness of the new fund amongst key target audiences is now beginning to pay off. In particular the targeted work of the #TrySomethingNew media campaign, coupled with extensive direct engagement, has had a significant impact.

Finally we plan to use the intelligence gained through: our internal audit/review; recipient/applicant feedback; management data; independent evaluation and research, to further enhance the fund and grow its reach over 2019/20. Note that at time of writing over 1000 applications have been logged on our database.

As reported above, we have had successful negotiations with our colleagues in COSLA this year. COSLA’s Health and Social Care Board have agreed to revise guidance on Local Authority Social Care charging of ILF recipients to mitigate the risk of any double charges and to protect any increased income ILF recipients receive as a result of ILF charging reductions linked to reform of our operational policies.

Despite the significant pull on Assessor Team resources resulting from the continued development of the Transition Fund, we are working through the second cycle of 2015 Fund bi-annual reviews in Scotland and NI. We are slightly behind schedule with these visits, however additional assessor capacity from 1st April 2019 should enable us to get back on schedule in the coming months.

During 2018/19 one of our key tasks during review visits has been rebalancing of support plans to reflect the additionality and independent living focus of ILF Scotland. This has progressed well in almost all local areas during the year. We have visited specific Local Authority partners to redress the last elements of historic imbalances inherited from our antecedent UK wide public body. In particular Glasgow City have agreed full rebalancing of all cases and we are working to agree a joint review schedule with a new dedicated Glasgow review team. Northern Ireland has rolled out Self Directed Support to its 5 Health and Social Care Trust areas and we have met with each Trust to re-enforce the additionality of ILF support and sharing learning from Scotland.

We have seen further increases in the complexity of Assessor reviews over the last year, which has seen an increase in time spent in working through the issues in the most complex cases. These are mainly grouped around: tightened SDS Eligibility Criteria putting pressure on quality of life funding for disabled people; incorrect benefits due to DWP errors; mitigating the negative impact of increased employment costs; the inconsistent implementation of SDS nationally; and, implementation of ILF Policy changes. We expect these issues to reduce as the effect of Policy change works through this review cycle, whilst a review of 2015 Fund operational efficiency is underway.

IT, Digital Transformation and Continuous Improvement – Digital Transformation has continued on two fronts for ILF Scotland with the introduction of the new Transition Fund Web Service and our Cyber Catalyst role for Scottish Government. The back office systems have worked well to receive, process and evaluate the applications for the new Transition Fund, but the paper based approach has introduced time delays to processing which will not be an issue when the web service becomes live. The project team to deliver the technical solution has been increased and most of the work has focused on the upgrade of the infrastructure ready to deploy the new web service.

Finance – This has been another strong year from a financial perspective with another clean external audit, further strengthening of finance systems and being a winner in the Public Finance Innovation Awards . Other key achievements or activities of note are as follows:

Information Governance – The bulk of the information governance this year has focused on GDPR with a whole organisational approach to information and data security. The high point of the year was an internal audit which confirmed that ILF Scotland had met the requirements for GDPR and the DPA 2018 with only one suggestion for improving our approach.

The audit identified that ILF Scotland was probably operating in the top 10% of all public bodies in this area and commented on the whole organisational approach to sound data protection practices. Key to the overall success in this area have been the appointments of a dedicated Data Protection Officer and IT Security Manager who collectively ensure the integrity of the organisational approaches to information security.

People – During this year we have continued to strengthen our approach and systems relating to HR and organisational development, to ensure our employee proposition is inclusive, life friendly, market leading and skills appropriate. This also included finalising the pay structure with the Scottish Government. Of particular note ILF Scotland has become a Top 10 UK wide employer in the Working Families 2018 Benchmark and the Best Small Employer at the 2018 Working Families Special Awards.

The company is committed to good employee relations and HR policies have been developed from best practice to ensure full compliance with employment and equalities legislation.

ILF Scotland seeks to actively manage sickness absences and has return to work meetings with staff to improve support on resumption of duties and discuss absence patterns and causes. This has dropped from 1.8% to 1.78% over the reporting period.

The company procurement policy ensures fair competition and value for money, with specific arrangements to encourage tenders from employers of disabled people in procurement exercises. ILF Scotland is committed to prompt payment of bills for goods and services received. Payments are normally made within the period specified in the contract. Where there is no contractual or other understanding, we endeavour to pay within 10 days of the receipt of the goods or services, or the presentation of a valid invoice or similar demand, whichever is later. In 2018-19 ILF Scotland paid 95% of invoices within 10 days (2017-18 97%) of receipt. The number of creditor days outstanding at the end of 2018-19 was 23.4 days (2017-18 15.2 days).

We report an increase in taxpayers’ equity for the year amounting to £217,696 which has been transferred to general reserve as set out on page 51.

ILF Scotland is financed out of Grant in Aid from SG for the purpose of making regular grants to individuals. Grant in Aid of £53.3 million (2017-18 £52.3 million) was utilised in Scotland and Northern Ireland to meet the needs of users and related administration costs.

Assets are held only for the purpose of managing the company.

The company requests and receives Grant in Aid on a monthly basis to meet its immediate cash needs. Procurement policies are designed to secure goods and services for immediate consumption during the year with best value for money at current cost, and without setting up complex financial instruments. Company exposure to financial instrument risk is therefore low compared with non-public sector organisations. The policies on financial instruments are provided in the Notes to the Accounts, and appropriate disclosures are included.

Company law requires the Directors to prepare accounts for each financial year. The Directors have elected under the Companies Act to prepare the accounts in accordance with IFRSs as adopted by the EU and applicable law and to provide additional disclosures required by the Government Financial Reporting Manual 2018- 19 where these go beyond the requirements of the Companies Act 2006.

All financial and other matters necessary for an effective external audit have been disclosed to the auditors. As far as the Directors are aware there is no relevant audit information of which the auditors are unaware; the Directors have taken all the steps necessary to make themselves aware of any relevant audit information and to ensure that the auditors are aware of that information.

The accounts are prepared on a ‘going concern’ basis. Grant in Aid is received on a cash basis to meet immediate need. Grants to individuals are paid in arrears and the Statement of Financial Position at 31 March 2019 shows a surplus net assets position of £2,324,666 as set out on page 49.

SG has provided a letter to the Chief Executive to confirm that Grant in Aid will be made available to cover the financial obligations of the company for the financial year 2019-20.

There were no events after the end of the financial year that have any material effect on these Reports and Accounts.

The company provides estimates of expenditure to support the requests of Grant in Aid. Directors are required to take reasonable steps to ensure expenditure does not exceed available funding.

The company continues to develop a robust risk management programme, identifying major risks against business objectives and implementing appropriate risk management measures. The SMT reviews risks and reports to the Audit Committee and Board of Directors on a quarterly basis. Appropriate controls and action plans for risk management are put in place and these are reviewed at the risk management meetings. A separate Annual Governance Statement is provided in this document.

Summary – This has been another strong year, delivering even further progress against our strategic plan with the strong growth of the new Transition Fund and improvements to the 2015 Fund. ILF Scotland’s Business Plan for 2019/2020 articulates the detailed priorities for the coming year.

Signed by the Chair of the Board on behalf of the Directors on 25 June 2019.

Susan Douglas-Scott, Chair of the Board

The Directors are responsible for preparing the Strategic Report, the Directors Report and the accounts in accordance with applicable law and regulations.

Company law requires the Directors to prepare accounts for each financial year. The Directors have elected under the Companies Act to prepare the accounts in accordance with IFRSs as adopted by the EU and applicable law and to provide additional disclosures required by the Government Financial Reporting Manual 2018- 19 where these go beyond the requirements of the Companies Act 2006.

Under company law directors must not approve the accounts until they are satisfied that they give a true and fair view of the state of affairs of the company and of the profit or loss of the company for that period. In preparing these accounts the Directors are required to:

The Directors are responsible for keeping adequate accounting records that are sufficient to show and explain the company’s transactions and disclose with reasonable accuracy at any time the financial position of the company and enable them to ensure that the accounts comply with the Companies Act 2006. They have general responsibility for taking such steps as are reasonably open to them to safeguard the assets of the company and detect fraud and other irregularities.

The Directors have decided to prepare a Directors Remuneration Report in order to comply with the requirements of the Government Financial Reporting Manual 2018- 19 in accordance with Schedule 8 to the Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008 made under the Companies Act 2006, to the extent that they are relevant.

The Directors are responsible for the maintenance and integrity of the corporate and financial information included on the company’s website.

Signed by the Chair of the Board on behalf of the Directors on 25 June 2019.

Susan Douglas-Scott, Chair of the Board

Directors are appointed by Scottish Ministers for a period of two years which can be extended at the discretion of Scottish Ministers.

The Directors are appointed from a variety of backgrounds on the basis of relevant experience gained and relevant skills required.

The Chief Executive together with the Senior Management Team are responsible for day to day operations and activities.

Personal performance objectives for the Senior Management Team are currently being developed.

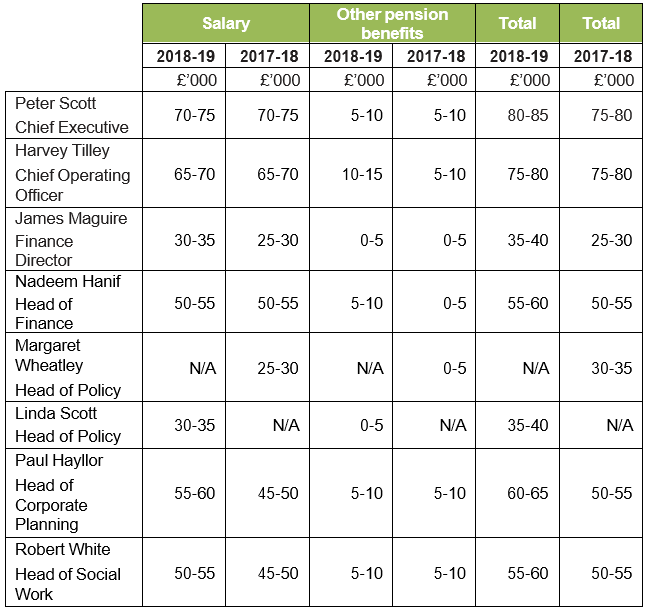

This report for the period ended 31 March 2019 deals with the remuneration of the Chief Executive, SMT and Directors of the Independent Living Fund Scotland.

ILF Scotland is managed by a Board of Directors appointed by Scottish Ministers. The Directors receive remuneration as post-holders and are reimbursed for incidental expenses in line with the company travel and subsistence policy. There are no unpaid persons or volunteers upon whose services the company is dependent.

The Remuneration Committee is appointed by the Board of Directors and is established to independently review the salary of the Chief Executive. The Chief Executive informs the Committee of any annual pay discussions to agree the salary levels for employees and SMT. The company complies with Scottish Government pay remit guidelines.

Members of the Committee for the period of this report were:

Fiona O’Donnell, Chair of the Remuneration Committee

Susan Douglas-Scott, Member of the Remuneration Committee

Elizabeth McAtear, Member of the Remuneration Committee

The terms of reference of the Remuneration Committee in relation to salary, rewards and conditions of service are:

The following sections provide details of the remuneration and pension interests of the Directors and the most senior company management. The figures below form part of the Remuneration Report to be audited as referred to in the Auditor’s Report.

For the year ended 31 March 2019 the total remuneration paid to Directors were:

| Name | 2018-19 | 2017-18 |

| £ | £ | |

| Susan Douglas-Scott (Chair) | 4,920 | 5,199 |

| Alan Dickson | 2,069 | 2,275 |

| Fiona O’Donnell | 1,901 | 1,004 |

| Bridget Sly | 222 | 2,028 |

| Elizabeth Humphreys | 4,217 | 3,066 |

| Elizabeth McAtear | 1,896 | 1,520 |

| Twimukye Macline Mushaka | 1,887 | 1,099 |

| Mark Adderley | 774 | N/A |

| Total | 17,886 | 16,191 |

In line with the company travel and subsistence policy a Director may also be reimbursed all reasonable and proper expenses incurred in carrying out their duties as a Director.

The Chief Executive and the SMT are employed on ILF Scotland terms and conditions.

The Directors have a policy regarding the senior management remuneration as follows:

The company is developing plans to have in place for the Chief Executive and the Senior Management Team, agreed objectives which are set by the Chairman of the Board of Directors and the Chief Executive respectively.

The Chief Executive’s and SMT performance will be reviewed annually with the overall assessment informed by quarterly one-to-one meetings.

In the event of early severance, compensation would be payable in accordance with company terms and conditions.

This table represents the part of the Remuneration Report to be audited as referred to in the Auditor’s Report.

There were no bonus payments arising during the period.

Both the company and employees contribute to a defined contribution stakeholder pension arrangement.

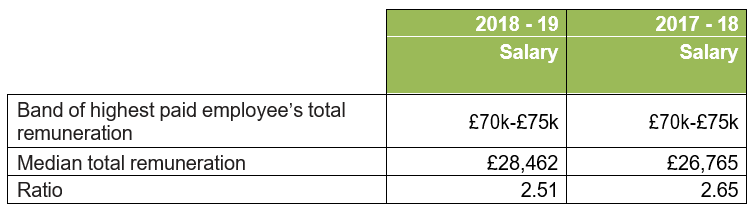

The banded remuneration of the highest paid employee in the company in the financial period 2018-19 was £70-75k (2017-18 £70-75k). This was 2.51 times (2017-18 2.65 times) the median remuneration of the workforce, which was £28,462 (2017-18 £26,765).

Total remuneration includes salary and benefits only. It does not include employer pension contributions.

The table above represents the part of the Remuneration Report to be audited as referred to in the Auditor’s Report.

Pension benefits are provided through a defined contribution stakeholder scheme.

The employer makes a basic contribution of between 6% and 12% depending on the employee contribution. Employee contributions are salary-related and range between 2% and 5% of pensionable earnings.

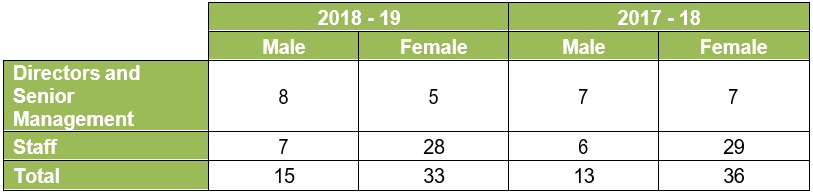

The table below shows the gender analysis of ILFS employees at 31 March.

The table below shows the staff absence analysis of ILFS employees for the year. Our absence rate falls within acceptable relevant comparable parameters. The current year includes two staff members on long-term sickness absence.

Our policy framework not only enables the delivery of our strategy but also supports the wishes, needs and aspirations of a modern workforce which is underpinned by a strong culture of trust, dignity and respect. This has not only helped ILF Scotland to be a beacon of independent living and innovative thinking for disabled people, but

also an award-winning employer of choice. For us there is no such thing as a normal employee and the framework had to take into account values, equality, diversity, young and more mature employees, families, caring responsibilities and make-up of modern society . By doing this, we know we attract and retain the best team possible to achieve our inclusive organisational aspirations.

To support the way we aspire to work, we have co-produced with colleagues a comprehensive approach that supports our collective health and wellbeing. This methodology is solidly based on an Organisational Development strategy, tailored to support the culture of inclusiveness, diversity, outcomes focus, trust, coaching and continuous improvement. We have put in place a suite of life-friendly policies, procedures, benefits and systems that can be tailored to meet individual circumstances. This includes working flexibly, compressed hours, being sympathetic to individual/family emergencies or remote working and providing the right

technology to do the job. We trust our staff to complete the work when they can around their agreed working hours and there is no expectation of taking work home or outside of hours working – unless it meets their needs.

Fiona O’Donnell, Remuneration Committee Chair

Signed by the above on 25 June 2019

The Board of Directors have responsibility for maintaining sound corporate governance systems that support the achievement of our policies, aims and objectives and safeguard the public funds and assets for which we are personally responsible.

Our responsibilities for managing public money and the duties assigned to us have been exercised with due diligence and the appropriate professional care.

The role of ILF Scotland is to deliver discretionary cash payments directly to disabled people, allowing them the choice and control to purchase personal support and live independent lives in their communities.

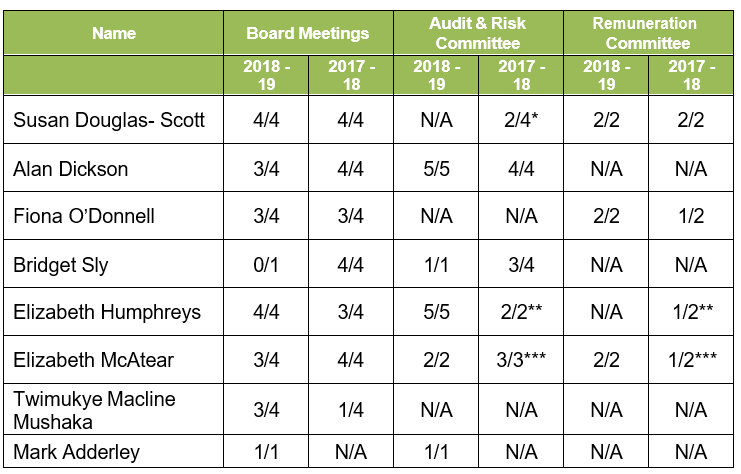

* Not a committee member. Attendance as an observer on occasion.

** Transferred from Remuneration Committee to Audit & Risk Committee in January 2018.

*** Transferred from Audit & Risk Committee to Remuneration Committee in January 2018. Also acted as temporary member of Audit & Risk Committee in 2018/19.

Our corporate governance systems continue to be drawn up from best practice recommendations and are being strengthened through internal scrutiny, legislative and process compliance and through collaborative working with both internal and external auditors.

These systems address individual and corporate accountabilities, the roles and effectiveness of our boards and our capacity to identify and effectively manage and report risk.

The company strategic aims and objectives have been developed by the Directors along with our sponsor team at the Scottish Government (SG). Our Chief Executive attends quarterly meetings chaired by SG officials. These meetings discuss significant business and programme risks and review ongoing progress against plan.

The programme meetings chaired by SG officials are supported by regular operational meetings with the sponsor team, members of specialist teams and other SG colleagues to ensure clarity of purpose, sound communication and effective reporting.

The Board met four times in formal session this period. There were also various board development days and committee meetings. All meetings have a pre-agreed agenda, are minuted and produced clear actions and matters arising. Meetings are attended by Directors and appropriate members of the SMT.

The Directors have a responsibility for maintaining sound systems of control to address key financial and other risks, ensuring that the requirements of the ILF Scotland founding documents are met, that high standards of corporate governance are demonstrated, and for reviewing the effectiveness of the systems of internal control.

The Chief Executive acts as the Risk Champion for the company, whilst lead responsibility for ensuring that appropriate mechanisms are in place for identifying, monitoring and controlling risk, and advising SMT on the actions needed in order to comply with our corporate governance requirements rests with the Chief Operating Officer, who also acts in the capacity of the ILF Scotland Senior Information Risk Owner (SIRO).

Our systems and processes are designed to manage risk to a reasonable and appropriate level rather than to eliminate all risk; therefore it can only provide reasonable and not absolute assurance of effectiveness.

Our Directors meet quarterly to address our strategic business priorities and the strategic risks associated whilst the SMT meets fortnightly.

Reviewing our strategic risks is a standing item at Board meetings, the SMT and the Audit & Risk Committee.

The Audit & Risk Committee provides a high-level resource that tests the adequacy of assurance on our risk management framework and internal control environment. The Audit & Risk Committee is attended by representatives of internal audit and, when appropriate, external audit.

Whilst every member of staff has a responsibility to ensure that exposure to risk is minimised, overall leadership of the risk management processes rests with members of the SMT.

The Risk Management Framework (RMF) sets out the organisation’s attitude to risk and provides a consistent basis to capture, monitor and report risks and to progress strategies to mitigate these. In assigning lead risk owners at SMT level and in the management control processes, we identify clear lines of responsibility throughout the organisation.

Our overall risk appetite is risk averse. This does not mean that we avoid opportunities to improve. However, it does mean that we are rightly cautious when challenges may hinder or put at risk our core business and service provision to our users.

Our risk management processes enable us to identify operational, business and financial risks, customer focus and delivery risks as well as identifying and assessing potential reputational risks and other contingent issues.

This year our emerging risks were mainly in connection with the setting up of the Transition Fund which commenced making payments in April 2018, the management of resources, the deployment of independent contractors and managing the movement of personal and sensitive information.

Our risks have been discussed within the organisation and where necessary we defined new roles and responsibilities, we introduced new measures, with improved management information and where appropriate attached a specific manager.

The managers’ role is to monitor, report on and manage these issues and risks.

Within our programme we have a significant challenge and risk involved in transferring sensitive user and confidential corporate data to our partners and client departments. This has required close liaison with relevant partners to ensure that we meet our legal responsibilities under the Data Protection Act. Data and information security has been managed as a high priority item.

In terms of data and information security breaches there have been no reportable incidents.

As Directors, we have responsibility for reviewing the effectiveness of the system of corporate governance, including systems of internal control. Our review is informed by the work of the SMT who has responsibility for development and maintenance of the internal control framework, and guided by advice from internal and external auditors.

We have been advised on the implications of my review of the effectiveness of the system of internal control by the SMT and the Audit & Risk Committee. As Chair of the Board I am confident that the Board of Directors and Audit & Risk Committee can draw significant assurance from the activity and reporting from SMT.

We also have in place independent internal auditors to examine our governance, risk management and control processes and they have provided their opinion that there is reasonable assurance that effective risk management, control and governance processes are in place based upon their programme of work during the year.

The internal control systems SMT have put in place include:

The Board has set up its governance arrangements to ensure compliance with best practice and relevant legislation.

The Board has developed terms of reference for all boards and committees, including their purpose, membership, and the election of the lead Director as well as defining the management and reporting requirements for each internal function.

Our governance processes and mechanisms to manage our boards are consistently applied to capture discussions, actions, risks and progress. These provide a basis for consistent reporting and ease of read-across to inform recommendations, actions and outcomes, our boards include the SMT, the Audit & Risk Committee and the Remuneration Committee.

The SMT meets regularly and is responsible for ensuring that corporate risks are identified as early as possible, are properly managed, that cross-functional issues are considered, and that risk management receives a high profile in planning and delivery of our plans. The SMT along with some of our senior managers meets weekly to ensure that all attendees understand both the priorities of the week and any emerging issues.

The Audit & Risk Committee met five times during the period and is responsible for ensuring, as far as possible, that appropriate systems are in place within the company for the assessment and management of risk and advising the Board on the effectiveness of the systems of governance and control, leading to signing off the Annual Governance Statement.

The Audit & Risk Committee reviews Strategic Risks as a standing item, it routinely considers the effectiveness of payment security, fraud management and recovered and unspent monies, it reviews the internal audit plans to ensure sufficient rigor and detail and undertakes to provide a questioning and challenging role to obtain assurance.

The Remuneration Committee met twice during the year. It oversees and reports to the Directors on the salaries, rewards and conditions of service in place at the company. It also makes sure that ILF Scotland conducts its employee relations fairly, efficiently and effectively.

Internal controls and procedures have been further strengthened with a formal partnership with NHS Counter Fraud Services and the implementation of a continuous improvement plan following in depth internal review.

During the course of the year we have become aware of and have investigated seven instances of suspected fraud in relation to fund recipients. The total amount estimated to be involved is up to £199,000 (2017-18 £49,000).

All cases have been reported to NHS Counter Fraud Services for investigation and one case has been progressed to the Procurator Fiscal. As these payments were recorded as costs when originally advanced they do not represent a further cost if deemed to be irrecoverable.

Over the course of the year there have been no significant control weaknesses reported, nor has any report been made externally, independently nor via the company Whistle-blower policy.

Our audit and internal management reporting remains vigilant to ensure early identification of issues within normal day-to-day business and no significant issues have emerged.

We have managed our risks and highlighted issues with foresight and taken decisions as required; we have forecast and reported our financial position in a timely accurate manner and maintained our budget within expected parameters.

Whilst as a relatively new organisation we continue to develop and improve our internal control and governance systems, in conclusion we believe that they were fit for purpose during the reporting period.

Susan Douglas-Scott

Chair of the Board

25 June 2019

The directors submit their annual report for the year ended 31 March 2019.

The Directors have elected under the Companies Act to prepare the accounts in accordance with IFRSs as adopted by the EU and applicable law and to provide additional disclosures required by the Government Financial Reporting Manual 2018- 19 where these go beyond the requirements of the Companies Act 2006.

The principal activities are described on page 11. The organisation became a Non- Departmental Public Body in June 2018, having previously been an Other Significant Public Body.

Susan Douglas-Scott

Chair of the board

Alan Dickson

Non-executive director

Fiona O’Donnell

Non-executive director

Bridget Sly

Non-executive director (resigned 9 June 2018)

Elizabeth Humphreys

Non-executive director

Elizabeth McAtear

Non-executive director

Twimukye Macline Mushaka

Non-executive director (resigned 29 January 2019)

Mark Adderley

Non-executive director (appointed 29 January 2019)

For further information, please see the Governance Statement on pages 34 to 39. All non-executive directors are considered to be independent.

None of the directors had any beneficial interest in the ownership of the company throughout the period. The company is guaranteed by the Scottish Ministers.

Full details of the movement in non-current assets are given in Notes 6 and 7 to the Accounts.

It is ILF Scotland’s aim to keep employees informed about its affairs and in particular those matters that affect them directly. The company regularly issues all-staff emails and is in the process of developing a staff Intranet site.

ILF Scotland is an Equal Opportunities Employer and actively encourages applications from disabled people.

The company contributes to a defined contribution stakeholder pension scheme as part of the remuneration package to staff.

There were no reportable Information losses in the period.

The Board is charged with maintaining a sound system of internal control that supports the achievement of the ILF Scotland policies, aims and objectives and regularly reviewing the effectiveness of that system. The Board is also responsible for the Governance Statement.

The Board’s Governance Statement is provided on pages 34 to 39.

The Board is responsible for ensuring that effective corporate governance arrangements are in place that set out how ILF Scotland is directed and controlled and how the assurance on risk management and internal control is provided.

The Board is required to demonstrate high standards of corporate governance at all times and to ensure that best practice is followed consistent with the UK Corporate Governance Code and appropriate adaptations of Corporate Governance in the Central Government Departments Code of Good Practice. The responsibilities of the Board are set out in the Governance Statement.

The remuneration for the Chair and Non-Executive Directors is determined by The Scottish Ministers. The remuneration of the Chief Executive is determined by the Board, subject to approval by The Scottish Ministers.

The Non-Executive Directors are appointed by The Scottish Ministers for a fixed term appointment of two years which can be extended at the discretion of The Scottish Ministers.

Members of the Committee are appointed by the Board. The Board determines the membership and terms of reference. The Chair of the Committee will report back to the Board after each meeting as required and the minutes of Committee meetings will be provided to Directors for information. Remuneration Committee meetings will normally be attended by the Chief Executive and the Chief Operating Officer.

For further information, please see the Remuneration Report on pages 27 to 31 and the Governance Statement on pages 34 to 39.

Members of the Committee are appointed by the Board. The Board determines the membership and terms of reference. The Chair of the Committee will report back to the Board after each meeting as required and the minutes of Committee meetings will be provided to Directors for information. Audit Committee meetings will normally be attended by the Chief Executive and the Chief Operating Officer.

Both external and internal audit have the right to independent access to the Chairman and members of the Committee.

Further details regarding the Audit & Risk Committee can be found in the Governance statement on pages 34 to 39.

The Directors who held office at the date of approval of the Directors’ Report confirm that, so far as they are each aware, there is no relevant audit information of which the External Auditor is unaware; and each Director has taken all steps that they ought to have taken as a Director to make themself aware of any relevant audit information and to establish that the External Auditor is aware of that information.

Details of all fees earned by the External Auditor are provided in note 5 of the annual accounts.

A resolution regarding the appointment of Auditor to the Company was approved at the June 2019 Board meeting.

By order of the Board

James A Maguire

Company Secretary

25 June 2019

We have audited the financial statements of ILF Scotland for the year ended 31 March 2019 which comprise the Statement of Comprehensive Net Expenditure, the Statement of Financial Position, the Statement of Cash Flows, the Statement of Changes in Taxpayers’ Equity and the related notes, including a summary of significant accounting policies. The financial reporting framework that has been applied in their preparation is applicable law and International Financial Reporting Standards (IFRS) as adopted by the European Union and as applied in accordance with the provisions of the Companies Act 2006, and as interpreted and adapted by the 2018-19 Government Financial Reporting Manual (‘the 2018-19 FReM’).

In our opinion the financial statements:

We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our responsibilities under those standards are further described in the Auditor's responsibilities for the audit of the financial statements section of our report. We are independent of the company in accordance with the ethical requirements that are relevant to our audit of the financial statements in the UK, including the FRC’s Ethical Standard, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

We have nothing to report in respect of the following matters in relation to which the ISAs (UK) require us to report to you where:

The directors are responsible for the other information. The other information comprises the information included in the Annual Report, other than the financial statements and our auditor’s report thereon. Our opinion on the financial statements does not cover the other information and, except to the extent otherwise explicitly stated in our report, we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If we identify such material inconsistencies or apparent material misstatements, we are required to determine whether there is a material misstatement in the financial statements or a material misstatement of the other information. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact.

We have nothing to report in this regard.

In our opinion, based on the work undertaken in the course of our audit:

In our opinion:

In the light of the knowledge and understanding of the company and its environment obtained in the course of the audit, we have not identified material misstatements in the Strategic Report or the Directors' Report.

We have nothing to report in respect of the following matters where the Companies Act 2006 requires us to report to you if, in our opinion

As explained more fully in the Statement of Directors' Responsibilities set out on page 26, the directors are responsible for the preparation of the financial statements and for being satisfied that they give a true and fair view, and for such internal control as the directors determine is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, the directors are responsible for assessing the company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the directors either intend to liquidate the company or to cease operations, or have no realistic alternative but to do so.

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs (UK) will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements. We are also responsible for giving an opinion on the regularity of expenditure and income in accordance with the 2018-19 FReM.

A further description of our responsibilities for the audit of the financial statements is located on the Financial Reporting Council’s website at: http://www.frc.org.uk/auditorsresponsibilities. This description forms part of our auditor’s report.

This report is made solely to the company’s members, as a body, in accordance with Chapter 3 of Part 16 of the Companies Act 2006. Our audit work has been undertaken so that we might state to the company’s members those matters we are required to state to them in an auditor's report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the company and the company’s members as a body, for our audit work, for this report, or for the opinions we have formed.

Stephen Cartwright (Senior Statutory Auditor)

For and on behalf of MHA Henderson Loggie

Chartered Accountants

Statutory Auditor

The Vision Building

20 Greenmarket

Dundee

DD1 4QB

25 June 2019

MHA Henderson Loggie is a trading name of Henderson Loggie LLP.

| Expenditure | Notes | 2018-19 | 2017-18 |

| £ | £ | ||

| Grants to individuals | 3 | 50,574,497 | 49,780,857 |

| Staff costs | 4 | 1,710,713 | 1,435,148 |

| Depreciation and amortisation | 5 | 29,329 | 27,788 |

| Other expenditure | 5 | 776,772 | 686,627 |

| Total comprehensive net expenditure for the year | 53,091,311 | 51,930,420 |

All expenditure relates to continuing operations.

The notes on pages 52 to 66 form part of these accounts.

| Notes | 31 March 2019 | 31 March 2018 | |

| Non-current assets | £ | £ | |

| Property, plant and equipment | 6 | 1,130 | 5,533 |

| Intangible assets | 7 | 152,507 | 161,511 |

| Total non-current assets | 153,637 | 167,044 | |

| Current assets | |||

| Trade and other receivables | 9 | 1,431,977 | 86,691 |

| Cash and cash equivalents | 10 | 5,010,734 | 4,851,136 |

| Total current assets | 6,442,711 | 4,937,827 | |

| Total assets | 6,596,348 | 5,104,871 | |

| Current liabilities | |||

| Trade and other payables | 11 | (183,578) | (1,258,681) |

| Other liabilities – grant liabilities | 11 | (3,838,340) | (1,574,019) |

| Other liabilities – deferred income | 11 | (202,575) | (76,025) |

| Total current liabilities | (4,224,493) | (2,908,725) | |

| Total assets less current liabilities | 2,371,855 | 2,196,146 | |

| Non-current liabilities | |||

| Deferred income – capital grants | 12 | (47,189) | (89,176) |

| Net assets | 2,324,666 | 2,106,970 | |

| Taxpayers’ equity | |||

| General reserve | 2,324,666 | 2,106,970 | |

| Total taxpayers’ equity | 2,324,666 | 2,106,970 |

The notes on pages 52 to 66 form part of these accounts.

These accounts were approved and authorised for issue by the Directors on 25 June 2019.

Susan Douglas-Scott, Chair of the Board

| Notes | 2018-19 | 2017-18 | |

| Cash flows from operating activities | £ | £ | |

| Net expenditure | (53,091,311) | (51,930,420) | |

| Depreciation and amortisation | 5 | 88,283 | 42,827 |

| Amortisation of capital grant | 12 | (58,954) | (15,039) |

| (Increase) in trade and other receivables | 9 | (1,345,286) | (45,666) |

| Increase/(Decrease) in trade and other payables, grant liabilities and provisions | 11/12 | 1,308,434 | (6,450,398) |

| Net cash outflow from operating activities | (53,098,834) | (58,398,696) | |

| Purchase of Fixed assets | 7 | (74,876) | (160,072) |

| Net cash outflow from investing activities | (74,876) | (160,072) | |

| Cash outflows from financing activities | |||

| Grant Funding and sundry income | 53,309,007 | 52,157,826 | |

| Capital grant | 12 | 24,301 | 152,872 |

| Net cash flows from financing activities | 53,333,308 | 52,310,698 | |

| Net Increase/(Decrease) in cash and cash equivalents in the period | 159,598 | (6,248,070) | |

| Cash and cash equivalents at the beginning of the period | 4,851,136 | 11,099,206 | |

| Cash and cash equivalents at the end of the period | 10 | 5,010,734 | 4,851,136 |

The notes on pages 52 to 66 form part of these accounts.

| General Reserve | ||

| £ | £ | |

| Balance at 1 April 2018 | 2,106,970 | |

| Changes in Taxpayers’ equity 2018-2019 | ||

| Grant in aid from departments | 53,193,483 | |

| Net expenditure | (53,091,311) | |

| 102,172 | ||

| Sundry Income | 115,524 | |

| Balance at 31 March 2019 | 2,324,666 | |

| Balance at 1 April 2017 | 1,879,564 | |

| Changes in Taxpayers’ equity 2017-2018 | ||

| Grant in aid from departments | 52,157,826 | |

| Net expenditure | (51,930,420) | |

| 227,406 | ||

| Balance at 31 March 2018 | 2,106,970 |

General reserve – relates to the ongoing operation of regular payments to individuals and the associated administration costs, financed by Grant in Aid.

Grant in Aid is not drawn in full in advance but requested each calendar month to meet estimated cash payments during the year.

Scottish Government has provided a letter to the Chief Executive to confirm that Grant in Aid will be made available to cover the financial obligations of the company for the financial year 2019-20.

The notes on pages 52 to 66 form part of these accounts.

The Independent Living Fund Scotland commenced operations in July 2015. The company is limited by guarantee. The guarantor is The Scottish Ministers.

ILF Scotland carries out the functions previously carried out by the Independent Living Fund (2006) within Scotland and Northern Ireland. There is also an agreement between the Scottish Government and the Department of Health (DOH), Northern Ireland for ILF Scotland to administer ILF payments to ILF users based in Northern Ireland

It is financed by Grant in Aid from Scottish Government to provide assistance with the cost of qualifying support and services to disabled applicants and to meet the operating costs of the company. The Grant in Aid amount is approved annually and confirmed in a letter of delegation.

The Directors have elected under the Companies Act to prepare the accounts in accordance with IFRSs as adopted by the EU and applicable law and to provide additional disclosures required by the Government Financial Reporting Manual 2018- 19 where these go beyond the requirements of the Companies Act 2006.

The Accounts are prepared on a ‘going concern’ basis. Grant in Aid is received on a cash basis to meet immediate need. Grants to individuals are paid in arrears and the Statement of Financial Position at 31 March 2019 shows a net assets position.

Scottish Government has provided a letter of to the Chief Executive to confirm that Grant in Aid will be made available to cover the financial obligations of the company for the financial year 2019-20.

No amendment or interpretations have been issued but are not yet effective, and that are available for early adoption, have been applied by the company in these financial statements. There are no amendments or interpretations issued, but not yet effective, which are expected to have a material effect on the financial statements in the future.

a) Accounting convention

These accounts have been prepared under the historical cost convention modified for the revaluation of non-current assets.

b) Property, plant and equipment

Property, plant and equipment consists of IT equipment. ILF Scotland believes that the useful economic life is a realistic reflection of the life of its equipment, and the

depreciated historical cost method provides a realistic reflection of the consumption of those assets. The company therefore carries plant and equipment at cost less accumulated depreciation and any recognised impairment in value.

c) Depreciation

Depreciation on property, plant and equipment is charged on a straight-line basis to write off the cost less residual values over the useful life of the asset: incepting at the purchase date, or when the asset is available for use, whichever is the later. IT hardware and equipment is depreciated over a three-year life span.

Residual values, remaining useful lives and depreciation methods are reviewed annually and adjusted if appropriate.

d) Intangible assets

Intangible assets consist of bespoke software developed for the company and software licences held only for the purpose of managing the company. All intangible assets are carried at fair value.

Bespoke software assets are capitalised in these accounts in the year of implementation. Amortisation is on a straight line basis over the estimated useful life of three years.

Software licences are capitalised in these accounts in the year of acquisition. Amortisation is on a straight line basis over the estimated useful life.

Amortisation periods and methods are reviewed annually and adjusted if appropriate.

e) Financial instruments

The company procurement policy is to enter into contracts and framework agreements for services and supplies at current agreed costs with annual price reviews, rather than create complex financial instruments.

Financial assets and financial liabilities are recognised in the Statement of Financial Position when ILF Scotland becomes party to the contractual provisions of the instrument.

Financial assets and liabilities are recognised at fair value (the transaction price plus any directly attributable transaction costs, assessed for recoverability where relevant). Subsequent measurement is at amortised cost, although no adjustment for the time value of money is made where the settlement period is short so there would be no significant effect.

Financial assets comprise loans and receivables, which are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. Loans and receivables comprise cash at bank, accrued bank interest and other

receivables. Financial liabilities comprise grant liabilities, trade payables and accruals.

f) Reserves policy

Grant in Aid is not drawn in full in advance but requested each calendar month to meet estimated cash outflow. The company does not hold strategic reserves as it is dependent on public funding.

g) Grant in Aid

Funding to cover grants to individuals and administrative expenditure is provided through Grant in Aid from the Scottish Government. Grant in Aid is received on the basis of the ILF Scotland estimated cash payments during the financial year. Grant in Aid received forms part of the Departmental Expenditure Limits for the respective Departments. Grant in Aid is treated as financing rather than income and is directly credited to reserves.

h) Grants to individuals

Grants to individuals are discretionary grants made within Scottish Government rules and regulations. 2015 Fund grants are paid four weekly in arrears on the basis of authorised awards. Transition Fund grants are paid once applications have been approved and processed. Amounts due but unpaid at the end of the financial year are accrued in these accounts.

Unused grants returned by individuals in the normal course of business are recognised on receipt and there is no accrual for potential future returns of unspent grants.

i) Formal recovery of grants to individuals

Although grants to individuals are discretionary payments, formal recovery will be sought where the provision of incorrect information has led to incorrect payment or where the grants have not been used for the intended purpose. The company will seek to recover all amounts where it is cost-effective to do so unless it will cause hardship to the individual. Recovery procedures appropriate to the value and circumstances of the case will be used, in accordance with the ILFS guidelines and procedures.