Any enquiries related to this publication should be sent to:

ILF Scotland, Denholm House, Almondvale Business Park, Almondvale Way, Livingston, EH54 6GA

Registered in Scotland. Phone: 0300 200 2022. Email: enquiries@ilf.scot

Performance Report

Accountability Report

Independent Auditor's Report to the members of ILF Scotland

Financial Statements

ILF Scotland is a Non-Departmental Public Body (NDPB) of the Scottish Government (SG). Our role is to provide a high quality service to, currently, over 6,000 disabled people in Scotland and Northern Ireland (NI), supporting them to achieve positive independent living outcomes, and to have greater choice and control over their lives.

ILF Scotland commenced operations in July 2015. We work in partnership with 37 Health and Social Care Partnerships/Trusts (HSCP/Ts) across Scotland and NI by jointly assessing and funding person centred care and support.

Operating from our central office in Livingston we employ (at 31 March 2022) 73 dedicated people including our social care professionals and nonexecutive directors. Our assessors visit our recipients in their own homes every two years to identify their needs often in conjunction with local authority or trust social services departments.

ILF Scotland

Denholm House

Almondvale Business Park

Almondvale Way

Livingston

EH54 6GA

Registered in Scotland

Tel: 0300 200 2022

Email: enquiries@ilf.scot

Website: www.ilf.scot

ILF Scotland was set up in 2015 and carries out the functions previously carried out by the Independent Living Fund (2006) within Scotland and NI. Its aim is to deliver discretionary cash payments to disabled people, allowing them the choice and control to purchase personal support and live independent lives in their communities. The organisation became an NDPB of SG in June 2018 (having previously been an Other Significant Public Body) and receives funding in the form of Grant in Aid from SG. There is also an agreement between the SG and the Department of Health in NI for ILF Scotland to administer ILF payments to ILF recipients based in NI.

Details of the Directors can be found here via the link below or directly on the company website:

Board of Directors - ILF

Details of the Senior Management Team (SMT) can be found here

Important external contacts are noted below:

Statutory auditor

Deloitte LLP

110 Queen Street

Glasgow G1 3BX

Solicitor

Central Legal Office

Breadalbane Street

Edinburgh

EH6 5JR

Internal auditor

MHA Henderson Loggie

29 Greenmarket

Dundee

DD1 4QB

Banker

Royal Bank of Scotland

36 St. Andrew Square

Edinburgh

EH2 2AD

The last 12 months has, without doubt, been the busiest and most challenging period since the inception of ILF Scotland, due to the impact of the global pandemic Covid 19. We have worked hard to be supportive, and innovative, in our response to this pandemic, introducing many new measures and initiatives to help recipients, key stakeholders and staff get through the year with as little impact on well-being as possible in such challenging circumstances. However, as we look back over the last 12 months of dealing with the pandemic, as both an organisation and nation, it has clearly taken a heavy toll on us all. That said, the resilience, determination and solidarity shown by our recipients, and the professionalism, empathy, compassion and sheer hard work of all involved in ILF Scotland has been truly humbling to watch.

This section of our Annual Report and Financial Statements sets out an overview of the last year. Such was the impact of Covid-19 on our recipients that much of this report addresses how we dealt with this and how we responded to the many challenges it presented. Performance is therefore measured against both how we dealt with the effects of Covid-19 and how we performed against our Strategic Plan.

Our key outcomes from our Strategic Plan are listed below:-

Further information on these outcomes are set out in pages 10 to 15 together with the Key Performance Indicators (KPI’s) against which we monitor performance.

This year our principal risks and uncertainties were mainly in connection the Covid19 pandemic, managing the continued growth of the Transition Fund, the management of resources, managing the movement of personal and sensitive information, managing Information Technology (IT) security and our core long standing risks in relation to funding and policy changes. We believe that we responded very well to all risk areas and this is explored further in the “Performance Analysis” section of this report.

Risk is further addressed in the Annual Governance Statement on pages 31 to 32.

As we move slowly out the pandemic, the last 12 months have seen the busiest operational period since we first went live in 2015. This in part has been due to the impact of Covid-19, but also due to the continuing success of the Transition Fund, coupled with day to day operations alongside the delivery of our strategic plan. We have continued to work hard in being supportive, innovative and flexible in our response to the pandemic as we slowly edge to a new normal. However, what is clear from our work with disabled people, is the impact of Covid-19 will take many years to unravel.

Overall there has been significant progress towards the three strategic priorities in our business plan and the sense of high level support for re-opening the 2015 Fund in both Scotland and NI. Of key note alongside the business plan, ILF Scotland also successfully delivered in collaboration with Scotland Excel and Self Directed Support Scotland (SDSS), SG's pandemic “thank you” payment scheme to just under 5,000 Personal Assistants (PAs). This was an exceptionally complicated piece of work, which mainly took place in Quarters (Q) 2 and 3 of our year. Due to this success, ILF Scotland was approached by the NI Government to provide a similar scheme which has been developed and will be delivered in our new financial year.

From an operational perspective, we have stayed fully open throughout the financial year, supporting over 6,000 disabled people (this number includes closed cases) across Scotland and NI to have choice, control and dignity. We have dealt with over 18,000 contacts via phone, text and email compared with just over 11,000 the year before, and this increase is mainly due to growth in the number of individuals supported alongside the complexity of issues.

Over the year 2015 Fund (our main fund) recipient numbers have dropped to 2,435 (Scotland 2,056 & NI 379) from 2,572 (Scotland 2,160 & NI 412). This represents an increase in the overall decline trend from around 4.4% (4.2% Scotland & 5.5% NI) in 2020/21 to 5.3% (4.8% Scotland & 8% NI) in 2021/22. Correspondingly the total number of individuals supported through the Transition Fund (our fund aimed exclusively at young disabled people in the age bracket 16-25) has increased by 47.2% from 2,575 to 3,790 by the year end.

Worryingly though, disabled people are telling us that they are experiencing even more difficult times as we relax pandemic protections, which risks further deepening existing societal inequalities.

Though the cost of living has mainly become more acute in the latter half of the financial period, for disabled people this has made scarce resources even harder to stretch. When this is added to the ongoing challenges of living with Covid-19 and the social care staffing predicament, the situation for disabled people is arguably as bleak as it has been for decades.

This is being starkly highlighted as we have returned to physical reviews for the 2015 Fund throughout the year. We are seeing much more complexity in these as a result of the aforementioned reasons, which is further exacerbated by the slow rebuilding of statutory services in the community. To that end, our reviews are taking considerably longer to complete, with our clear priority to ensure disabled people are able to live with choice, control and dignity. The difficulties set out above have further strengthened the case for the re-opening of the 2015 Fund in both Scotland and NI where forward momentum has continued throughout the reporting period. By the year end, there were submissions with Ministers in NI for their consideration and, subject to approval, we look forward to working alongside key stakeholders to make this a reality for disabled people.

To support the increasing year on year work pressures on staff, we have carried on renewing and refreshing our employee offer. This has included the introduction of new measures and initiatives, expanded later in the report, to help our staff get through the year whilst enabling them to bring their best to the workplace. We are very proud to have again been awarded a Top 10 UK Employer in the annual Working Families benchmark in September 2021, especially in the context of our busiest year ever. But, we are even more proud of the continued excellence, passion, hard work and professionalism of colleagues who have performed brilliantly throughout 2021-22.

In summary, it has been another extraordinary year for ILF Scotland dealing with the profound impact of Covid-19 on us all alongside the increasing cost of living. We have had the busiest, yet in some ways the most rewarding reporting period, by any benchmark since opening in July 2015. Looking forward, we continue to work towards: re-establishing normal operations; continued implementation of our strategy; extending the Transition Fund; re-opening the 2015 Fund to new applications in Scotland and NI (subject to Ministerial approval); supporting SG to deliver the recommendations in the Independent Review of Adult Social Care; and enabling even more disabled people to live independently.

Looking back over the year, overall there has been strong progress towards our three strategic priorities.

Two key areas worth highlighting are the full review of our policy suite to ensure they remain fit for purpose, and the progression of our Equalities Mainstreaming, Corporate Parenting and Charter for Involvement Action Plans. These have been key pieces of work and we are delighted to have progressed these in the year.

Internally, ILF Scotland remains under significant Covid related pressures, and despite media reports that the crisis is now over, infection and hospitalisation rates remain high, with resultant health concerns for our own workforce and our ability to operate safely in the community. We have made a strong start to the very lengthy and complex unravelling of recipient award packages as a result of the pandemic. This has resulted in detailed negotiations around care and support packages, placing additional time pressures on both our Assessors and Caseworkers to follow through on agreed review outcomes and actions. In tandem with this, we have seen considerable growth in the applications coming into the Transition Fund.

Looking to the future and fulfilling the current strategy, significant progress has been made on the digital transformation business case and organisational sustainability. Both areas look to achieve greater efficiency through smarter use of technology, of staff, of resources and operational processes to reduce our consumption and work towards a Net Zero position by 2040. Key work has been completed to create an operational framework for taking all this forward during the final year of this strategy (2020-23), and is on track to deliver our Net Zero Action Plan by the end of this current strategy period.

Overall the business plan is on track to deliver the strategic priorities by the end of this current strategic cycle and we are hopeful about its key priority of re-opening the 2015 Fund.

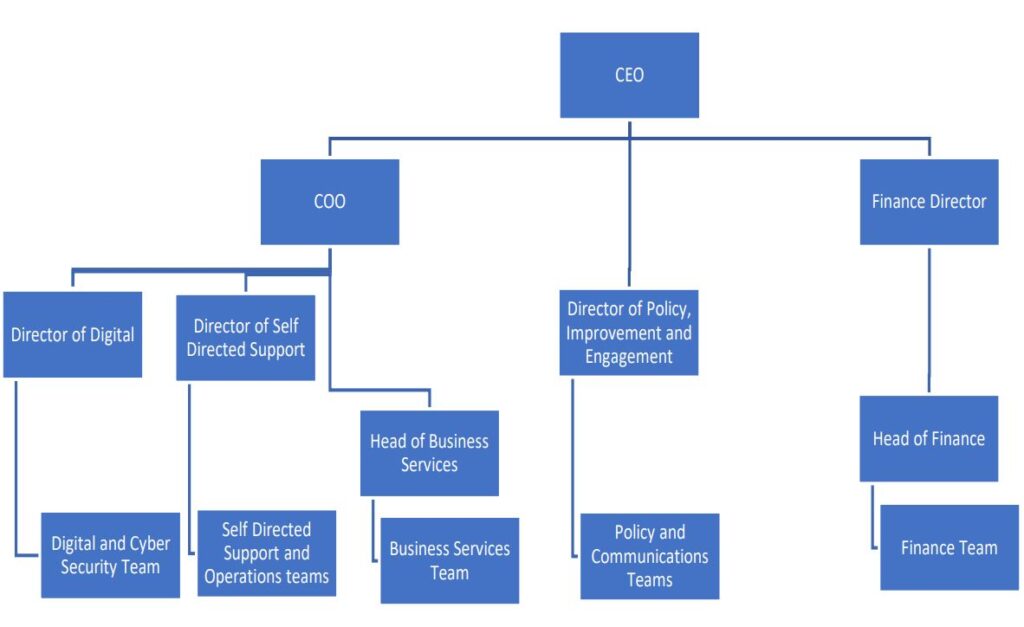

An organisational chart can be found in the People section on page 20.

Target Outcome: The evidence base is further developed to support the reopening of the 2015 Fund.

Key Performance Indicators:

Activity Update: Despite the pressures encountered as a consequence of the pandemic, the Ministerial submission for the reopening in NI was completed in Q4 and has been submitted to the Minister for Health for a decision on next steps, which we expect to happen early in the next financial year.

Status: Green

Target Outcome:

Key Performance Indicators:

Activity Update:

Status: Green

Target Outcome:

Key Performance Indicators:

Activity update:

Status: Green

Target Outcome:

Key Performance Indicators:

Activity Update:

Status: Green

Target Outcome:

Key Performance Indicators:

Activity Update:

Status: Green

Target Outcome:

Key Performance Indicators:

Business Case for capital investment to support service delivery transformation submitted to sponsor team and health finance by May 2021.

Activity Update:

Status: Amber

Efficiencies - We constantly carry out improvement and efficiency work and this has enabled the organisation to deliver more. Over the year we have carried out improvements that have saved 1,548 (2020-21 - 7,600) hours of staff time. This works out at approximately one (2020-21 - four) Full Time Equivalent (FTE) staff which is around 1.5% (2020-21 - 7.4%) of our workforce. This equates to an approximate overall saving of 1.2% of our cost base (2020-21 - 5.7%) compared to the SG target of 3%.

Our efficiencies are down year on year for a number of reasons. During the year our staff focus was on returning to normal operations following on from the Covid-19 pandemic. We also employed more operational staff to focus on our recipients which in turn affected our ability to generate efficiencies. Due to extensive work in previous years we are moving to a position where only smaller gains can be realised without the capital investment referred to above.

Social Work Update - Over the reporting period we have moved back to physical reviews though due to the infection rates, we have had to constantly adjust our operational posture. To enable reviews to come to a completion, we have temporarily waived a number of key policies and procedures around Local Authority engagement and service input because Local Authorities advise they can currently only deal with emergency assessments in many areas. We anticipated that Local Authorities would be able to return to providing the majority of funding for 2015 fund recipients from April 2022, however the continuation of Covid-19 Policy flexibilities until 30 June 2022 makes that date a better fit. This also fits with early intelligence from contact with HSCP/Ts that the lifting of restrictions has coincided with increased staff absence. It is expected when this peak is passed, a widespread re-opening of statutory services is anticipated in the next financial year.

However the ongoing additional support role currently being undertaken by ILF Scotland Assessors, whilst vital to recipients during the pandemic, is unsustainable. In 2019-20 we completed 1,900 review visits, a typical year. In 2020-21 during the height of the pandemic, we completed 172 visits, though it should be noted we carried out over 5,000 in depth welfare calls during this period instead. Through 2021-22 when pandemic restrictions were largely in place we completed 400 review visits. We need to renew and clarify our role for the next year to stakeholders if we wish to get back to the necessary rate of visits to offer a visit every two years.

This year we continued to engage with NI Trust leads and Scottish HSCP leads. In Scotland this has also meant working closely with Social Work Scotland on various SDS projects and joining the new SDS National Collaboration and a new cross party group on Social Work hosted by SG.

Summary – The operational environment remains challenging for staff supporting very stretched and stressed carers (who very much welcome a visit) and anxious and isolated young people to apply to the Transition Fund. Many ordinary policies and procedures are suspended for good reason yet it adds layers of complexity to decision making and delays in processing reviews. We intent to assert our role and policies in the next financial year to bring better inputs from HSCP/Ts and complete review visits at a rate that sees a return to the two year cycle with the important benefits that a visit brings to recipients.

Policy and Improvement - We comprehensively reviewed all of our 2015 and Transition Fund policies in 2021-22.

Covid-19 policy flexibility continued throughout the year with both the Scottish and NI Governments extending this to the end of June 2022. We continue to pay additional sums for replacement awards to a small number of recipients.

We have made good progress in implementing actions in our published Equalities Mainstreaming and Outcomes and Corporate Parenting reports Charter for Involvement Standards.

Communications and Engagement - The Communications team delivered external communication (direct and digital) to all our stakeholders on the following:-

The build and development of our new website is on track and we remain on schedule for the planned June 2022 launch date. This improvement will make a significant difference in how our key external stakeholders are able to access and engage with vital information on our website.

In celebration of International Women's Day, we launched a fantastic blog from one of our Scottish Recipient Advisory Group members and recipients, Nic Reid, on why more disabled women are needed in leadership positions.

In conjunction with this we completed extensive online events throughout the year with a number of in-person events in Q4. We also focused this engagement work with key stakeholders and partners in areas where the organisation is receiving the least applications to the Transition Fund - Moray, Western Isles and Orkney. This will continue into Q1 and Q2 of 2022-23 in line with the aims of our Corporate Parenting Plan and Equalities Mainstreaming Action Plan.

To complement this and to encompass an all-round strategic communications approach, we also delivered a successful paid social media and PR campaign, which achieved a combined total reach of 97,172 people.

Complaints - For the full 2021-22 year we received 34 complaints compared to 14 in 2020-21. The majority of these complaints related to the Transition Fund. Complaints in 2020-21 saw a significant drop compared to the previous year. We think this was because people were pre-occupied dealing with the pandemic. In 2021-22, complaints picked up again and were similar in number to that of 2019-20. We received 9 complaints about the 2015 Fund and 25 about the Transition Fund, 5 of which were

from the same person. We capture each learning point from this valuable feedback about our service and act to address any issues raised through revised procedures, staff training, etc. in the spirit of continuous organisational improvement.

Overview - 2021-22 has again been a most challenging and extremely busy year, possibly the most challenging since ILF Scotland was created in 2015. Alongside additional projects, Covid-19 and volume of work we have seen increasing year on year work pressures. This year has again seen a comparatively low attrition rate with one original staff member retiring and two others leaving to promoted posts. Our absence rate has understandably remained higher than we would like as we work our way through the pandemic predominantly with several long term absences. We have continued to offer innovative support to our workforce, introducing new measures and initiatives to help our staff get through the year and are very proud to have again been awarded a Top 10 Employer in the annual Working Families benchmark in September.

We have, as always, tried to remain an optimistic, open and supportive employer. The Health and Wellbeing programme has remained front and centre of our decision making as we made our way through the year offering several workshops including ‘Reconnecting and dealing with anxiety as we exit Covid-19’. We continued through the year to meet all staff monthly (digitally) and this will continue into 2022-23 as we emerge from the pandemic. ‘Keeping in Touch’ with smaller staff groups remains

important to reconnect. Our Trickle App has been used twice monthly to gauge staff mood through our ‘mood-sense pulse surveys’, reacting appropriately to comments and feedback. The Trickle App has built momentum over the last year and is now embedded as a great tool to connect with staff and engage on relevant issues, including anonymously if preferred.

The year has seen continuing pressures on staff as a result of new projects, increased workload and Covid-19. We remain vigilant and not complacent that the impact continues to challenge us all. Current planning is underway to continue offering further Mental Health & Resilience workshops from the Strong Mind Resilience Team and promote our own Mental Health First Aiders to all staff.

During this year we supported another student Social Worker from Stirling University who completed her placement at the end of November 2021. We look forward to welcoming more students through 2022-23.

During Q4, planning started to introduce an ‘Employee Passport’ which is a voluntary scheme to encourage all staff to discuss adjustments they may require for underlying health conditions, disabilities, caring responsibilities and personal needs with their line manager – recording it only once. This passport can be taken from team to team or across SG and other public bodies who use the scheme. This passport ensures employees only have to share their individual needs and adjustments once as it is recorded in the passport. The passport is led by the employee and should be reviewed

regularly.

Organisational Demography – By the end of Q4 2021-22 the organisational make up was 73: staff (66) and Directors (7); 74%:26% female: male, with 20.54% of staff self-identified as disabled, 4.10% BME and 1.36% LGBT.

Employment status – During 2021-22 we have continued to be a supportive work friendly employer offering a suite of life friendly policies . We have listened and reacted to feedback from colleagues through our Staff Survey and Trickle which has informed positive change.

ILF Scotland offers different contractual opportunities to all our staff. This continues to provide stability and continuity for both the organisation and individuals at this time of uncertainty. During 2021-22 all staff have worked 100% flexibly and we will continue to ensure staff can have a work/life harmony which suits their individual circumstances and the needs of the organisation. Detailed planning work is underway looking at our Workforce Plan, considering new duties ILF Scotland may be formally requested to discharge in due course.

The structure of the organisation can be seen below. The chart sets out our core operational departments:-

Records Management - The reporting period has seen significant progress towards the implementation of the new corporate file plan and Shared Drive reconfiguration. The future state move for ILF Scotland is to be away from the SG IT infrastructure and to have its own instance of a single data repository for its own records. The first step in this is having a fully cleansed and properly structured records management system which at a future state can be "lifted and shifted" into any new cloud based operating platform. There have been some capacity issues with SG not being able to support us through this so additional resource was approved by SMT to use contractors (who are also the main SG contractors). Work progresses well and once our permissions levels are set, all staff will be able to migrate their records into the new structure with the completion date planned in early 2022-23.

Digital and System Developments - The in-year developments have progressed well and are in final testing stage ready for a go-live during Q1 of 2022-23. We have slowed the work down to allow for the implementation of the second Social Care Living Wage uplift and the Special Recognition Payments project in NI, alongside the end of year activities of the Transition Fund and Communications Team. So far the demonstrations of the Local Authority portal and the Technology Grants have been well received and once year-end activities are over, these will be the priority projects. Still in the digital space, much additional work was completed on the business case for transformation funding and has been submitted to colleagues in the sponsor team and health finance for review and consideration. This piece of work, whilst having a strong technical driver, sits in the context of re-opening ILF Scotland to new applicants and what the new operational model might look like and the staffing structure to deliver its services. Whereas the current efficiencies reported equate to the saving of one FTE annually, the digital transformation project has the potential for significant further automation or digitisation of the current line of business activities, and so represents a significant potential change to how ILF Scotland operates in the future.

Risk and Resilience - The work on the resilience project has almost reached the end of Phase 1 which is the creation of the individual resilience solutions for the different work areas. An initial disaster scenario walk through exercise was completed to test these new solutions and once refined, will be taken forward to run a full desktop exercise for senior managers early in the new financial year. This will

also be the time period in which the Resilience Hub will become operational and will bring together all critical processes, resilience solutions, crisis communications and crisis response teams. The team has been incredibly busy and alongside all the change activity, have kept us safe from cyber-attacks and protected our data.

The company is committed to good employee relations and HR policies have been developed from best practice to ensure full compliance with employment and equalities legislation.

ILF Scotland seeks to actively manage sickness absences and has return to work meetings with staff to improve support on resumption of duties and discuss absence patterns and causes.

The company procurement policy ensures fair competition and value for money, with specific arrangements to encourage tenders from employers of disabled people in procurement exercises. ILF Scotland is committed to prompt payment of bills for goods and services received. Payments are normally made within the period specified in the contract. Where there is no contractual or other understanding, we endeavour to pay within 10 days of the receipt of the goods or services, or the

presentation of a valid invoice or similar demand, whichever is later.

In 2021-22 ILF Scotland paid 99% of invoices within 10 days (2020-21 97%) of receipt. The number of creditor days outstanding at the end of 2021-22 was 25 days (2020-21 18 days). Our creditor days outstanding has been distorted by one particularly large invoice received at the year end.

• Awards Paid – The payments made to recipients for the year 2021-22 was £49.2m (2020-21 £52.7m), of which £1.4m (2020-21 £3.2m), was for the Transition Fund.

• Reserves – We have healthy reserves at just over £5m at 31 March 2022 (£2.6m at 31 March 2021).

• External Audit – This is the final year that our audit will be performed by Deloitte. Audit Scotland have been appointed for the financial years 2022/23 to 2026/27.

• Internal Auditors – We carried out a tender exercise this year and our incumbent internal auditors, Henderson Loggie, were successful and have been appointed for a further three years.

• Process Review - Work continues by our Finance department conducting a thorough review of all its key processes. As a result of this review, we will be able to ensure any best practice and any procedural efficiencies are implemented.

We report an increase in taxpayers’ equity for the year amounting to £2,457,015 which has been transferred to general reserve as set out on page 66.

ILF Scotland is financed out of Grant in Aid from SG for the purpose of making regular grants to individuals. Grant in Aid of £55.4 million (2020-21 £57.2 million) was utilised in Scotland and NI to meet the needs of users and related administration costs.

Assets are held only for the purpose of managing the company.

The company requests and receives Grant in Aid on a monthly basis to meet its immediate cash needs. Procurement policies are designed to secure goods and services for immediate consumption during the year with best value for money at current cost, and without setting up complex financial instruments. Company exposure to financial instrument risk is therefore low compared with non-public

sector organisations. The policies on financial instruments are provided in the Notes to the financial statements, and appropriate disclosures are included.

Company law requires the directors to prepare financial statements for each financial year. The financial statements comply with the Companies Act 2006 and the directors have adopted to prepare them in accordance with IFRSs and applicable law and to provide additional disclosures required by the Government Financial Reporting Manual 2021-22 where these go beyond the requirements of the

Companies Act 2006.

The financial statements are prepared on a ‘going concern’ basis. Grant in Aid is received on a cash basis to meet immediate need. Grants to individuals are paid in arrears and the Statement of Financial Position at 31 March 2022 shows a net assets position of £5,084,033 as set out on page 64.

SG has provided a letter to the Chief Executive to confirm that Grant in Aid will be made available to cover the financial obligations of the company for the financial year 2022-23.

There were no events after the end of the financial year that have any material effect on these Reports and Financial Statements.

As well as living through the greatest health crisis of our generation, 2021 marked a call to arms from all quarters of the world during the UN COP26 Climate Change conference held in Glasgow in November. For a few weeks, Scotland became centre stage in discussions on literally how best to save the planet and the next 10 years will be crucial in creating sustainable plans to reduce our resource consumption and slow global warming by becoming carbon neutral.

Covid -19, extreme weather conditions across the globe, the semi-conductor crisis and now staffing crisis in critical front line services have rightly focused on “rightsizing” scare resources and setting priorities for organisations to reduce not only their current consumption, but to embed sustainable plans to de-carbonise and become Net Zero by 2040.

Following on from the development of our new Strategy in 2020, as an Executive Public Body ILF Scotland is committed and aligns to the general climate change duties set out under Section 44 of the Climate Change (Scotland) Act 2009. Although not a listed public body with the requirement to report directly against the carbon reduction targets, ILF Scotland takes environmental matters very seriously and is working towards its own Net Zero targets by 2040. ILF Scotland is now linked in to the Scottish Government Climate Change team and are gaining valuable information into responsibilities, requirements, measurement tools, reporting frameworks and bodies of expert knowledge on implementing Net Zero action plans.

Our approach is more than becoming paperless or using green energy sources – it is built into our strategy and operational practices and is an attempt at a whole organisational drive to right-size and appropriately source the resources we require to deliver our business objectives. This approach encompasses five domains and a further five operational practices.

The five Domains provide the framework for a more sustainable and carbon neutral ILF Scotland by 2040.

To bring this together at the whole organisational level, five inter-related activities consider the environmental and carbon reduction measures required to achieve net zero.

It should be noted that the current continuous improvement activity and efficiency management reporting have identified considerable in-year time savings for the front line operations. Once a full baseline activity of current carbon impact is made and understood, future improvements can be strategically prioritised and focused on those activities either contributing most to carbon footprint, or those processes and activities that take up the most amount of time and resources.

There is the potential for further operational and resources consumed savings by becoming more digitally enabled as an organisation, as well as the benefits this will give to our recipients by being able to self-serve at a time and manner convenient to them, without the need to send letters and forms back to us.

At a future point, the more our recipients are able to do for themselves, the fewer staff resources in comparison we would need to support them which in turn reduces the carbon footprint and resources consumed by more staff members. This illustrates our thinking and the next stage is to set realistic targets for carbon reduction, staffing numbers, fuel and buildings costs and travel and devices. This emerging framework will give us a basis to bring all of this together during this last year of our current strategy.

ILF Scotland has been largely unaffected by Brexit. We are a SG and NI

Government funded organisation serving our recipients in Scotland and NI. We will continue to monitor any possible impact.

ILF Scotland is committed to equality of opportunity and has policies and procedures in place to ensure this is achieved. It also fully recognises its legal responsibilities, particularly in respect of race relations, age, sex and disability discrimination and complies with all Scottish Government policies in relation to Human Rights and Equality.

ILF Scotland is subject to the Equality Act 2010 (General Duties) (Scotland) Regulations (see link below) and must also publish statements on equal pay and information about Board members.

Equality Act 2010: guidance - GOV.UK (www.gov.uk)

ILF Scotland is committed to the highest standards of ethical conduct and integrity and is committed to the prevention of bribery and corruption as we recognise the importance of maintaining our reputation and the confidence of our stakeholders.

We can report that no instances of corruption or bribery were recorded in 2021-22 (2020-21 nil).

Summary – This has been another strong year, delivering even further progress against our strategic plan.

Authorised for issue by the Board of Directors.

Signed by the Chair of the Board on behalf of the directors and also signed by the Accountable Officer on 28 June 2022.

Susan Douglas-Scott, Chair of the Board

Peter Scott, Accountable Officer

Consisting of: Corporate Governance Report; Remuneration and Staff Report; and Parliamentary Accountability Report

The Corporate Governance Report consists of three sections:

The directors and the Accountable Officer are responsible for preparing the Strategic Report (referred to as the “Performance Report” above), the Directors Report and the financial statements in accordance with applicable law and regulations.

Company law requires the directors to prepare financial statements for each financial year. The financial statements comply with the Companies Act 2006 and the directors have adopted to prepare them in accordance with IFRSs and applicable law and to provide additional disclosures required by the Government Financial Reporting Manual 2021-22 where these go beyond the requirements of the Companies Act 2006.

Under company law directors must not approve the financial statements until they are satisfied that they give a true and fair view of the state of affairs of the company and of the profit or loss of the company for that period. In preparing these financial statements the directors are required to:

The directors are responsible for keeping adequate accounting records that are sufficient to show and explain the company’s transactions and disclose with reasonable accuracy at any time the financial position of the company and enable them to ensure that the financial statements comply with the Companies Act 2006. They have general responsibility for taking such steps as are reasonably open to them to safeguard the assets of the company and detect fraud and other irregularities.

The directors have decided to prepare a Directors’ Remuneration Report in order to comply with the requirements of the Government Financial Reporting Manual 202122 in accordance with Schedule 8 to the Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008 made under the Companies Act 2006, to the extent that they are relevant.

The directors are responsible for the maintenance and integrity of the corporate and financial information included on the company’s website.

As Accountable Officer, as far as I am aware, there is no relevant audit information of which ILF Scotland’s auditor is unaware. I have taken all reasonable steps to make myself aware of any relevant audit information and to establish that ILF Scotland’s auditor is aware of the information.

As Accountable Officer I am responsible for the regularity and propriety of the public finances for which I am answerable, for keeping proper records and for safeguarding ILF Scotland’s assets, as set out in the Memorandum to Accountable Officers for Parts of the Scottish Administration issued by Scottish Ministers.

As Accountable Officer I confirm that the annual report and financial statements as a whole are fair, balanced and understandable and I take personal responsibility for the annual report and financial statements and the judgements required for determining that it is fair, balanced and understandable.

Authorised for issue by the Board of Directors.

Signed by the Chair of the Board on behalf of the directors and also signed by the Accountable Officer on 28 June 2022.

Susan Douglas-Scott, Chair of the Board

Peter Scott, Accountable Officer

Scope of responsibility

The Board of Directors have responsibility for maintaining sound corporate governance systems that support the achievement of our policies, aims and objectives and safeguard the public funds and assets for which we are personally responsible. Our responsibilities for managing public money and the duties assigned to us have been exercised with due diligence and the appropriate professional care.

The role of ILF Scotland is to deliver discretionary cash payments directly to disabled people, allowing them the choice and control to purchase personal support and live independent lives in their communities.

Figures for 2021-22 in bold. (Figures for previous year, 2020-21, in brackets).

| Name | Board Meetings | Audit and Risk Committee | Renumeration Committee |

|---|---|---|---|

| Susan Douglas- Scott | 4/4 (4/4) | 2/4* (2/3*) | 2/2 (1/2) |

| Alan Dickson | 4/4 (4/4) | 4/4 (3/3) | N/A (N/A) |

| Elizabeth Humphreys | 4/4 (4/4) | 4/4 (3/3) | N/A (N/A) |

| Elizabeth McAtear | 4/4 (4/4) | N/A (N/A) | 2/2 (2/2) |

| Mark Adderley | 4/4 (4/4) | N/A (N/A) | 2/2 (2/2) |

| Anne-Marie Monaghan | 4/4 (4/4) | N/A (N/A) | 2/2 (2/2) |

| Etienne d'Aboville | 4/4 (4/4) | 4/4 (3/3) | N/A (N/A) |

* Attending as an observer.

Our corporate governance systems continue to be drawn up from best practice recommendations and are being strengthened through internal scrutiny, legislative and process compliance and through collaborative working with both internal and external auditors.

These systems address individual and corporate accountabilities, the roles and effectiveness of our boards and our capacity to identify and effectively manage and report risk.

The company strategic aims and objectives have been developed by the directors along with our sponsor team at SG. Our Chief Executive attends quarterly meetings chaired by SG officials. These meetings discuss significant business and programme risks and review ongoing progress against plan.

The programme meetings chaired by SG officials are supported by regular operational meetings with the sponsor team, members of specialist teams and other SG colleagues to ensure clarity of purpose, sound communication and effective reporting.

The Board met four times in formal session this period. There were also various board development days and committee meetings. All meetings have a pre-agreed agenda, are minuted and produced clear actions and matters arising. Meetings are attended by directors and appropriate members of the SMT.

The directors have a responsibility for maintaining sound systems of control to address key financial and other risks, ensuring that the requirements of the ILF Scotland founding documents are met, that high standards of corporate governance are demonstrated, and for reviewing the effectiveness of the systems of internal control.

The Chief Executive acts as the Risk Champion for the company, whilst lead responsibility for ensuring that appropriate mechanisms are in place for identifying, monitoring and controlling risk, and advising SMT on the actions needed in order to comply with our corporate governance requirements rests with the Chief Operating Officer, who is supported by the Director of Digital and Information in the capacity of the ILF Scotland Senior Information Risk Officer (SIRO).

Our systems and processes are designed to manage risk to a reasonable and appropriate level rather than to eliminate all risk; therefore it can only provide reasonable and not absolute assurance of effectiveness.

Whilst every member of staff has a responsibility to ensure that exposure to risk is minimised, overall leadership of the risk management processes rests with members of the SMT. The SMT meets fortnightly.

Reviewing our strategic risks is a standing item at Board meetings, supported by the work of the Audit & Risk Committee, which provides a high-level resource to test the adequacy of assurance on our risk management framework and internal control environment. The Audit & Risk Committee is attended by representatives of internal audit and, when appropriate, external audit.

The Risk Management Framework sets out the organisation’s attitude to risk and provides a consistent basis to capture, monitor and report risks and to progress strategies to mitigate these. In assigning lead risk owners at SMT level and in the management control processes, we identify clear lines of responsibility throughout the organisation.

Our overall risk appetite is risk averse. This does not mean that we avoid opportunities to improve. However, it does mean that we are rightly cautious when challenges may hinder or put at risk our core business and service provision to our users. Our risk management processes enable us to identify operational, business and financial risks, customer focus and delivery risks as well as identifying and assessing potential reputational risks and other contingent issues.

All bodies subject to the requirements of the Scottish Public Finance Manual (SPFM) must operate a risk management strategy in accordance with relevant guidance issued by the Scottish Ministers.

ILF Scotland maintains a strategic and operational risk register which records internal and external risks and identify the mitigating actions required to reduce the threat of these risks occurring and their impact. The Risk Management Strategy and Operational Risk Register are regularly updated and reviewed as a standing item by senior staff and the Audit and Risk Committee. Each individual risk is allocated an owner who ensures that mitigating action is carried out.

This year our principal risks were mainly in connection with the risks associated with managing recovery from the Covid-19 pandemic, managing the continued growth of the Transition Fund, the management of resources, managing the movement of personal and sensitive information, managing IT security and our core long standing risks in relation to funding and policy changes.

The risk and control processes applied within ILF Scotland accord with guidance given in the SPFM and have been in place for the year ended 31 March 2022 and up to the date of the approval of the annual report and financial statements.

A key part of our risk management process is the involvement of all staff in the discussion and identification of risks and their management. Together, we develop mitigating action, supported by management information and identify a specific manager to oversee progress.

The managers’ role is to monitor, report on and manage these issues and risks.

Within our programme we have a significant challenge and risk involved in transferring sensitive user and confidential corporate data to our partners and client departments. This has required close liaison with relevant partners to ensure that we meet our legal responsibilities under the Data Protection Act. Data and information security has been managed as a high priority item.

In terms of data and information security breaches there have been no reportable incidents.

As directors, we have responsibility for reviewing the effectiveness of the system of corporate governance, including systems of internal control. Our review is informed by the work of the SMT who have responsibility for development and maintenance of the internal control framework, guided by advice from internal and external auditors.

We also have in place independent internal auditors and they have provided their opinion that ILF Scotland has adequate and effective risk management, control and governance processes in place based upon their programme of work during the year. They also report that proper arrangements are in place to promote and secure Value for Money.

Directors take assurance from these sources that effective systems of corporate governance are in place throughout the organisation.

The internal control systems SMT have put in place include:

The Board has set up its governance arrangements to ensure compliance with best practice and relevant legislation.

The Board has developed terms of reference for all boards and committees, including their purpose, membership, and the election of the lead Director as well as defining the management and reporting requirements for each internal function.

Our governance processes and mechanisms to manage our boards are consistently applied to capture discussions, actions, risks and progress. These provide a basis for consistent reporting and ease of read-across to inform recommendations, actions and outcomes, our boards include the SMT, the Audit & Risk Committee and the Remuneration Committee.

The SMT meets regularly and is responsible for ensuring that corporate risks are identified as early as possible, are properly managed, that cross-functional issues are considered, and that risk management receives a high profile in planning and delivery of our plans. The SMT along with some of our senior managers meets fortnightly to ensure that all attendees understand both the priorities of the week and any emerging issues.

The Audit & Risk Committee met four times during the period and is responsible for ensuring, as far as possible, that appropriate systems are in place within the company for the assessment and management of risk and advising the Board on the effectiveness of the systems of governance and control, leading to signing off the Annual Governance Statement. The Audit & Risk Committee reviews Strategic Risks as a standing item, it routinely considers the effectiveness of payment security, fraud management and recovered and unspent monies, it reviews the internal audit plans to ensure sufficient rigor and detail and undertakes to provide a questioning and challenging role to obtain assurance.

The Remuneration Committee met twice during the year. It oversees and reports to the directors on the salaries, rewards and conditions of service in place at the company. It also makes sure that ILF Scotland conducts its employee relations fairly, efficiently and effectively.

Internal controls and procedures have been further strengthened with a formal partnership with NHS Counter Fraud Services and the implementation of a continuous improvement plan following in depth internal review.

During the course of the year we have become aware of and have investigated two (2020-21 two) instances of alleged fraud in relation to fund recipients. It has not been possible to quantify amounts involved since the allegations require full investigation before they can be proven and potential amounts quantified. As these payments were recorded as costs when originally advanced they do not represent a further cost if deemed to be irrecoverable.

All cases have been reported to NHS Counter Fraud Services.

Over the course of the year there have been no significant control weaknesses reported, nor has any report been made externally, independently nor via the company Whistle-blower policy.

Our audit and internal management reporting remains vigilant to ensure early identification of issues within normal day-to-day business and no significant issues have emerged.

We have managed our risks and highlighted issues with foresight and taken decisions as required; we have forecast and reported our financial position in a timely accurate manner and maintained our budget within expected parameters.

We continue to develop and improve our internal control and governance systems and in conclusion we believe that they were fit for purpose during the reporting period.

ILF Scotland has in place a range of systems and measures which ensure that information held by the organisation, and held by third parties on behalf of the organisation, is secure. ILF Scotland monitors compliance concerning the release of data from the organisation. In addition, ILF Scotland has implemented SG guidance on data security and information risk through the creation of an information asset register, which includes assessment of risk and awareness training for staff.

During 2021-22, we have been closely monitoring the requirements of the General

Data Protection Regulations (GDPR) and engaged with all staff regularly. Direct GDPR training has been rolled out to all staff, this is mandatory training and an annual refresher is provided with data protection updates. Physical data security is monitored by office checks, on a quarterly basis.

ILF Scotland continues to focus upon Cyber Security and Resilience and we have Cyber Essentials PLUS accreditation.

There are no significant lapses in data security to report in 2021-22 (2020-21: none).

Authorised for issue by the Board of Directors.

Signed by the Chair of the Board on behalf of the Directors and also signed by the Accountable Officer on 28 June 2022.

Susan Douglas-Scott, Chair of the Board

Peter Scott, Accountable Officer

Company Number SC500075

The directors submit their annual report for the year ended 31 March 2022.

The financial statements comply with the Companies Act 2006 and the directors have adopted to prepare them in accordance with IFRSs and applicable law and to provide additional disclosures required by the Government Financial Reporting Manual 2021-22 where these go beyond the requirements of the Companies Act 2006.

The principal activities are described on page 5. The organisation became an NDPB in June 2018, having previously been an Other Significant Public Body.

For further information, please see the Annual Governance Statement on pages 29 to 36.

All non-executive directors are considered to be independent.

None of the directors had any beneficial interest in the ownership of the company throughout the period. The company is guaranteed by the Scottish Ministers.

The only movement during the year was depreciation/amortisation of existing assets held at the beginning of the year and the disposal of fully depreciated assets.

It is ILF Scotland’s aim to keep employees informed about its affairs and in particular those matters that affect them directly. The company regularly issues all-staff emails and is in the process of developing a staff Intranet site.

ILF Scotland is an Equal Opportunities Employer and actively encourages applications from disabled people.

The company previously contributed to a defined contribution stakeholder pension scheme as part of the remuneration package to staff.

The company joined the Civil Service Pension Scheme on 1 September 2019. Most members of staff chose to join the defined benefit offering known as alpha.

The Board is charged with maintaining a sound system of internal control that supports the achievement of the ILF Scotland policies, aims and objectives and regularly reviewing the effectiveness of that system. The Board is also responsible for the Annual Governance Statement.

The Board’s Annual Governance Statement is provided on pages 29 to 36.

The Board is responsible for ensuring that effective corporate governance arrangements are in place that set out how ILF Scotland is directed and controlled and how the assurance on risk management and internal control is provided.

The Board is required to demonstrate high standards of corporate governance at all times and to ensure that best practice is followed consistent with the UK Corporate Governance Code and appropriate adaptations of Corporate Governance in the Central Government Departments Code of Good Practice. The responsibilities of the Board are set out in the Governance Statement.

A link to the company website giving more details about the Board of Directors and the Senior Management Team can be found on page 5. The Board of Directors is also listed on page 37.

The non-executive directors are appointed by The Scottish Ministers for a fixed term appointment of four years which can be extended at the discretion of The Scottish Ministers.

Full details of ILF Scotland’s Register of Interests can be found on our website

Members of the committee are appointed by the Board. The Board determines the membership and terms of reference. The chair of the committee will report back to the Board after each meeting as required and the minutes of Committee meetings will be provided to directors for information. Remuneration Committee meetings will normally be attended by the Chief Executive and the Chief Operating Officer.

For further information, please see the Annual Governance Statement on pages 29 to 36 and the Remuneration and Staff Report on pages 41 to 52.

Members of the committee are appointed by the Board. The Board determines the membership and terms of reference. The chair of the committee will report back to the Board after each meeting as required and the minutes of committee meetings will be provided to directors for information. Audit Committee meetings will normally be attended by the Chief Executive, the Finance Director and the Chief Operating Officer.

Both external and internal audit have the right to independent access to the chair and members of the committee.

Further details regarding the Audit & Risk Committee can be found in the Annual Governance Statement on pages 29 to 36.

The directors who held office at the date of approval of the Directors’ Report confirm that, so far as they are each aware, there is no relevant audit information of which the external auditor is unaware; and each director has taken all steps that they ought to have taken as a director to make themselves aware of any relevant audit information and to establish that the external auditor is aware of that information.

Details of all fees earned by the external auditor are provided in note 5 of the annual financial statements.

Under the Companies Act 2006 (Scottish public sector companies to be audited by the Auditor General for Scotland) Order 2008, a new auditor of the company has been appointed by the Auditor General for Scotland for 2022-23. The new auditor for the company with effect from 2022-23 is Audit Scotland.

Authorised for issue by the Board of Directors.

James A Maguire

Company Secretary 28 June 2022

Directors are appointed by Scottish Ministers for a period of four years which can be extended to a maximum of eight years at the discretion of Scottish Ministers.

The directors are appointed from a variety of backgrounds on the basis of relevant experience gained and skills required.

The Chief Executive together with the SMT are responsible for day-to-day operations and activities.

Personal performance objectives for the SMT are currently being developed.

This report for the year ended 31 March 2022 deals with the remuneration of the Chief Executive, SMT and directors of ILF Scotland.

ILF Scotland is managed by a Board of Directors appointed by Scottish Ministers. The directors receive remuneration as post-holders and are reimbursed for incidental expenses in line with the company travel and subsistence policy. There are no unpaid persons or volunteers upon whose services the company is dependent.

The Remuneration Committee is appointed by the Board of Directors and is established to independently review the salary of the Chief Executive. The Chief Executive informs the committee of any annual pay discussions to agree the salary levels for employees and SMT, in accordance with with Scottish Government pay remit guidelines.

Members of the committee for the period of this report were:

The terms of reference of the Remuneration Committee in relation to salary, rewards and conditions of service are:

The following sections provide details of the remuneration and pension interests of the directors and the most senior company management. The figures below form part of the Remuneration Report to be audited as referred to in the Auditor’s Report.

For the year ended 31 March 2022 the total remuneration paid to directors were:

2021-22 in £'000

2020-21 in £'000

Directors’ salary is non-pensionable.

The Chief Executive and the SMT are employed on ILF Scotland terms and conditions.

The directors apply the policy regarding senior management remuneration as follows:

The Chief Executive’s and SMT performance will be reviewed annually with the overall assessment informed by quarterly one-to-one meetings.

In the event of early severance, compensation would be payable in accordance with company terms and conditions.

This table represents the part of the Remuneration Report to be audited as referred to in the Auditor’s Report.

Salaries include gross salary, overtime and any other allowance to the extent that it is subject to UK taxation. This report is based on payments made within the year by ILF Scotland. There were no bonus payments or benefits in kind.

Figures for 2021-22. (Figures for previous year, 2020-21, in brackets).

Peter Scott, Chief Executive Officer

Harvey Tilley, Chief Operating, Officer/Acting CEO

James Maguire, Director of Finance

Nadeem Hanif, Head of Finance

Linda Scott, Director of Policy, Improvement & Engagement

Paul Hayllor, Director of Digital & Information Services

Robert White, Director of Selfdirected Support

The company joined the Civil Service Pension Scheme on 1 September 2019 and most members of staff chose to join the defined benefit offering (alpha).

Peter Scott, Chief Executive Officer

Harvey Tilley, Chief Operating, Officer/Acting CEO *

James Maguire, Finance Director *

Nadeem Hanif, Head of Finance *

Linda Scott, Director of Policy, Improvement & Engagement *

Paul Hayllor, Director of Digital & Information Services

Robert White, Director of Selfdirected Support

* These employees had transfers in from other personal pension schemes during the previous year and the above figures are reflective of this.

CETV is fully explained on page 47.

The Civil Service Pension Scheme are still assessing the impact of the McCloud judgement in relation to changes to benefits in 2015. The benefits and related CETVs disclosed do not allow for any potential future adjustments that may arise from this judgement.

The company joined the Civil Service Pension Scheme on 1 September 2019. Most staff members chose to join the scheme known as alpha which provides benefits on a career average basis with a normal pension age equal to the member’s State Pension Age. This statutory pension arrangement is unfunded with the cost of benefits met by monies voted by Parliament each year.

Employee contributions are salary related and range between 4.60% and 7.35% of pensionable earnings. At the end of the scheme year the member’s earned pension account is credited with 2.32% of their pensionable earnings in that scheme year. Employer contributions are salary-related and can be up to 30.30% of pensionable earnings.

The accrued pension quoted is the pension the member is entitled to receive when they reach pension age, or immediately on ceasing to be an active member of the scheme if they are already at or over pension age. Pension age is the higher of 65 or State Pension Age for members of alpha.

A few staff members have chosen to participate in the partnership pensions account which is a stakeholder pension arrangement. The employer makes a basic contribution of between 8% and 14.75% (depending on the age of the member) into a stakeholder pension product chosen by the employee from a panel of providers. The employee does not have to contribute, but where they do make contributions, the employer will match these up to a limit of 3% of pensionable salary (in addition to the employer basic contribution).

Employers also contribute a further 0.50% of pensionable salary in both schemes above to cover the cost of centrally-provided risk benefit cover (death in service and ill health retirement).

Further details about the Civil Service pension arrangements can be found at the website http://www.civilservicepensionscheme.org.uk

A Cash Equivalent Transfer Value (CETV) is the actuarially assessed capitalised value of the pension scheme benefits accrued by a member at a particular point in time. The benefits valued are the member’s accrued benefits and any contingent partner’s benefits payable from the scheme. A CETV is a payment made by a pension scheme or arrangement to secure pension benefits in another pension scheme or arrangement when the member leaves the scheme and chooses to transfer the benefits accrued in their former scheme. The pension figures shown relate to the benefits that the individual has accrued as a consequence of their total membership of the scheme, not just as their service in a senior capacity to which the disclosure applies.

The figures include the value of any pension benefit in another scheme or arrangement which the member has transferred to the civil service pension arrangements. They also include any additional pension benefit accrued to the member as a result of their buying additional pension benefits at their own cost. CETVs are worked out in accordance with The Occupational Pension Schemes (Transfer Values) (Amendment) Regulations 2008 and do not take account of any actual or potential reduction to benefits resulting from Lifetime Allowance Tax which may be due when pension benefits are taken.

This reflects the increase in CETV that is funded by the employer. It does not include the increase in accrued pension due to inflation, contributions paid by the employee (including the value of any benefits transferred from another pension scheme or arrangement) and uses common market valuation factors for the start and end of the period.

There were no ILF Scotland directors or staff that left on Voluntary Exit, Voluntary Redundancy or Compulsory Redundancy terms.

Year 2021-22

Year 2020-21

The banded remuneration of the highest paid employee in the company in the financial period 2021-22 was £80-85k (2020-21 £80-85k). The table above sets out how the various percentiles compare against the mid-point of the band of the highest paid employee.

We believe that the median pay ratios set out above are consistent with the pay, reward and progression policies for our employees taken as a whole. We adhere to SG pay policy.

All ratios of the are reasonably consistent with the previous year. The 75th percentile has increased year on year due to a number of additional non-senior management employees slotting into the upper quartile compared to the previous year. The effect of this was to pull down average earnings in this category hence the increase shown above.

Total remuneration includes salary only. There were no bonus payments or benefits in kind. It does not include employer pension contributions.

The table above represents the part of the Remuneration Report to be audited as referred to in the Auditor’s Report.

In 2021-22 one (2020-21 Nil) employee received remuneration in excess of the Chief Executive. Remuneration ranged from £21,045 to £83,890 (2020-21 £18,805 to £81,645).

The change in the banded remuneration of the highest paid employee year on year was 0%.

Year on year annualised average staff FTE remuneration decreased by 0.27%. This was due to the fact that staff levels increased during the year and these roles were mainly in pay categories below existing average pay levels within the organisation.

The table below shows the gender analysis of ILFS employees at 31 March.

Directors 2021-22: Three Male, Four Female

Directors 2020-21: Three Male, Four Female

Senior Management Team - 2021-22 - Six Male, One Female

Senior Management Team - 2020-21 - Six Male, One Female

Staff 2021-22: 10 Male, 49 Female

Staff 2020-21: Seven Male, 40 Female

Total 2021-22: 19 Male, 54 Female

Total 2020-21: 16 Male, 45 Female

The table below shows the staff absence analysis of ILFS employees for the year.

Absence rate 2021-22: 5.02%

Absence rate 2020-21: 5.02%

Short term absences remain at a low level at 2.28%. However we had several longer term absences (2.74%) in line with last year’s experience. We continue to offer mental health awareness, personal resilience and suicide prevention workshops to all staff on an annual basis with mental health first aiders being trained and now in post to support our workforce. Our whole-life friendly suite of policies also continues to support the workforce in a positive manner.

Note that the numbers above exclude non-executive directors. The numbers show staff employed at 31 March.

Our policy framework enables the delivery of our strategy and also supports the wishes, needs and aspirations of a modern workforce which is underpinned by a strong culture of trust, dignity and respect. This has helped ILF Scotland to be a beacon of independent living and innovative thinking for disabled people and also an award-winning employer of choice. For us there is no such thing as a normal employee and the framework had to take into account values, equality, diversity, young and more mature employees, families, caring responsibilities and make-up of modern society. By doing this, we know we attract and retain the best team possible to achieve our inclusive organisational aspirations.

To support the way we aspire to work, we have co-produced with colleagues a comprehensive approach that supports our collective health and wellbeing alongside delivering our organisational strategy. This methodology is solidly based on organisational development, tailored to support the culture of inclusiveness, diversity, outcomes focus, trust, coaching and continuous improvement.

We have put in place an award winning suite of whole-life-friendly policies, procedures, benefits and systems that can be tailored to meet individual circumstances. This includes working flexibly, compressed hours, being sympathetic to individual/family emergencies or remote working and providing the right technology to do the job.

Our above established policies proved to be invaluable when we, along with everyone in the country and indeed the world, were affected by the pandemic referred to as Covid-19. We quickly extended our remote working practices for all members of staff to keep both them and our recipients safe.

Staff turnover was 5% during the year (2020-21 1.85%) and is considered satisfactory. The 5% is made up of three employees, one of whom retired and two of whom left for promoted posts within SG.

The ILF Scotland staff survey 2021 had a 93% response rate from staff. 100% of survey respondents rated ILF Scotland as a ‘good employer’ and the organisation scored above the public sector average for questions relating to whether the organisational leadership live the core values. 90% of ILF Scotland staff feel they are valued at work by their colleagues, their manager and the senior management team with 92% citing that the whole-life-friendly working policies are what they themselves value most. 100% of ILF Scotland staff say that the flexibility offered enhances their life in general terms. The ‘organisations purpose’ was shown to be the main reason why staff enjoy working for ILF Scotland.

We, as an organisation, are happy to recognise trade unions and we make a point of engaging trade unions on important matters affecting staff. An example of this was when we changed the pension scheme offering to staff. Relevant trade unions were actively consulted and involved.

The Trade Union (Facility Time Publication Requirements) Regulations 2017 require public sector employers to publish information relating to facility time. At year end 31 March 2022, ILF Scotland did not have any trade union facility time (2020-21 Nil).

What was the total number of your employees who were relevant union officials during the relevant period?

How many of your employees who were relevant union officials employed during the relevant period spent a) 0%, b) 1%-50%, c) 51%-99% or d) 100% of their working hours on facility time?

Percentage of time / Number of Employees:

Provide the figures requested in the first column of the table below to determine the percentage of your total pay bill spent on paying employees who were relevant union officials for facility time during the relevant period.

As a percentage of total paid facility time hours, how many hours were spent by employees who were relevant union officials during the relevant period on paid trade union activities?

Mark Adderley, Remuneration Committee Chair

Peter Scott, Accountable Officer

Signed by the above on 28 June 2022

Losses and special payments

In accordance with the SPFM, we are required to disclose losses and special payments above £300,000. During 2021-22 there were no losses or special payments within this criteria (2020-21: £nil).

Gifts and Charitable Donations There were no gifts or charitable donations made during the year 2021-22 (2020-21: nil).

Remote Contingent Liabilities

ILF Scotland are required to report any liabilities for which the likelihood of a transfer of economic benefit in settlement is too remote to meet the definition of contingent liability under IAS37. There are currently no remote contingent liabilities.

Susan Douglas-Scott, Chair of the Board

Peter Scott, Accountable Officer

Signed by the above on 28 June 2022

We have audited the financial statements of ILF Scotland for the year ended 31 March 2022 under The Companies Act 2006 (Scottish public sector companies to be audited by the Auditor General for Scotland) Order 2008. The financial statements comprise the

Statement of Comprehensive Net Expenditure, the Statement of

Financial Position, the Statement of Cash Flows, the Statement of Changes in Taxpayers’ Equity and notes to the financial statements, including significant accounting policies. The financial reporting framework that has been applied in their preparation is applicable law and UK adopted international accounting standards, as interpreted and adapted by the 2021/22 Government Financial Reporting Manual (the 2021/22 FReM).

In our opinion the accompanying financial statements:

We conducted our audit in accordance with applicable law and International Standards on Auditing (UK) (ISAs (UK)), as required by the Code of Audit Practice approved by the Auditor General for Scotland. Our responsibilities under those standards are further described in the auditor’s responsibilities for the audit of the financial statements section of our report. We were appointed by the Auditor General on 17 June 2019. The period of total uninterrupted appointment is 3 years. We are independent of the company in accordance with the ethical requirements that are relevant to our audit of the financial statements in the UK including the Financial Reporting Council’s Ethical Standard, and we have fulfilled our other ethical responsibilities in accordance with these requirements. Non-audit services prohibited by the Ethical Standard were not provided to the company. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

We have concluded that the use of the going concern basis of accounting in the preparation of the financial statements is appropriate.

Based on the work we have performed, we have not identified any material uncertainties relating to events or conditions that, individually or collectively, may cast significant doubt on the company’s ability to continue to adopt the going concern basis of accounting for a period of at least twelve months from when the financial statements are authorised for issue.

These conclusions are not intended to, nor do they, provide assurance on the company’s current or future financial sustainability. However, we report on the company’s arrangements for financial sustainability in a separate Annual Audit Report available from the Audit Scotland website.

We report in our Annual Audit Report the most significant assessed risks of material misstatement that we identified and our judgements thereon.

As explained more fully in the Statement of the Directors' and Accountable Officer’s Responsibilities, the Accountable Officer and directors are responsible for the preparation of financial statements that give a true and fair view in accordance with the financial reporting framework, and for such internal control as the

Accountable Officer and directors determine is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, the Accountable Officer and directors are responsible for assessing the company's ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless there is an intention to discontinue the company’s operations.

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not a guarantee that an audit conducted in accordance with ISAs (UK) will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the decisions of users taken on the basis of these financial statements.

Irregularities, including fraud, are instances of non-compliance with laws and regulations. We design procedures in line with our responsibilities outlined above to detect material misstatements in respect of irregularities, including fraud. Procedures include:

The extent to which our procedures are capable of detecting irregularities, including fraud, is affected by the inherent difficulty in detecting irregularities, the effectiveness of the company’s controls, and the nature, timing and extent of the audit procedures performed.

Irregularities that result from fraud are inherently more difficult to detect than irregularities that result from error as fraud may involve collusion, intentional omissions, misrepresentations, or the override of internal control. The capability of the audit to detect fraud and other irregularities depends on factors such as the skilfulness of the perpetrator, the frequency and extent of manipulation, the degree of collusion involved, the relative size of individual amounts manipulated, and the seniority of those individuals involved.

A further description of the auditor’s responsibilities for the audit of the financial statements is located on the Financial Reporting Council's website. This description forms part of our auditor’s report.

Irregularities, including fraud, are instances of non-compliance with laws and regulations. We design procedures in line with our responsibilities outlined above to detect material misstatements in respect of irregularities, including fraud. Procedures include:

We obtained an understanding of the legal and regulatory framework that the body operates in, and identified the key laws and regulations that:

We discussed among the audit engagement team regarding the opportunities and incentives that may exist within the organisation for fraud and how and where fraud might occur in the financial statements.