Tuesday 5 December 2023 – 10.30am to 12.30pm

Online via Microsoft Teams

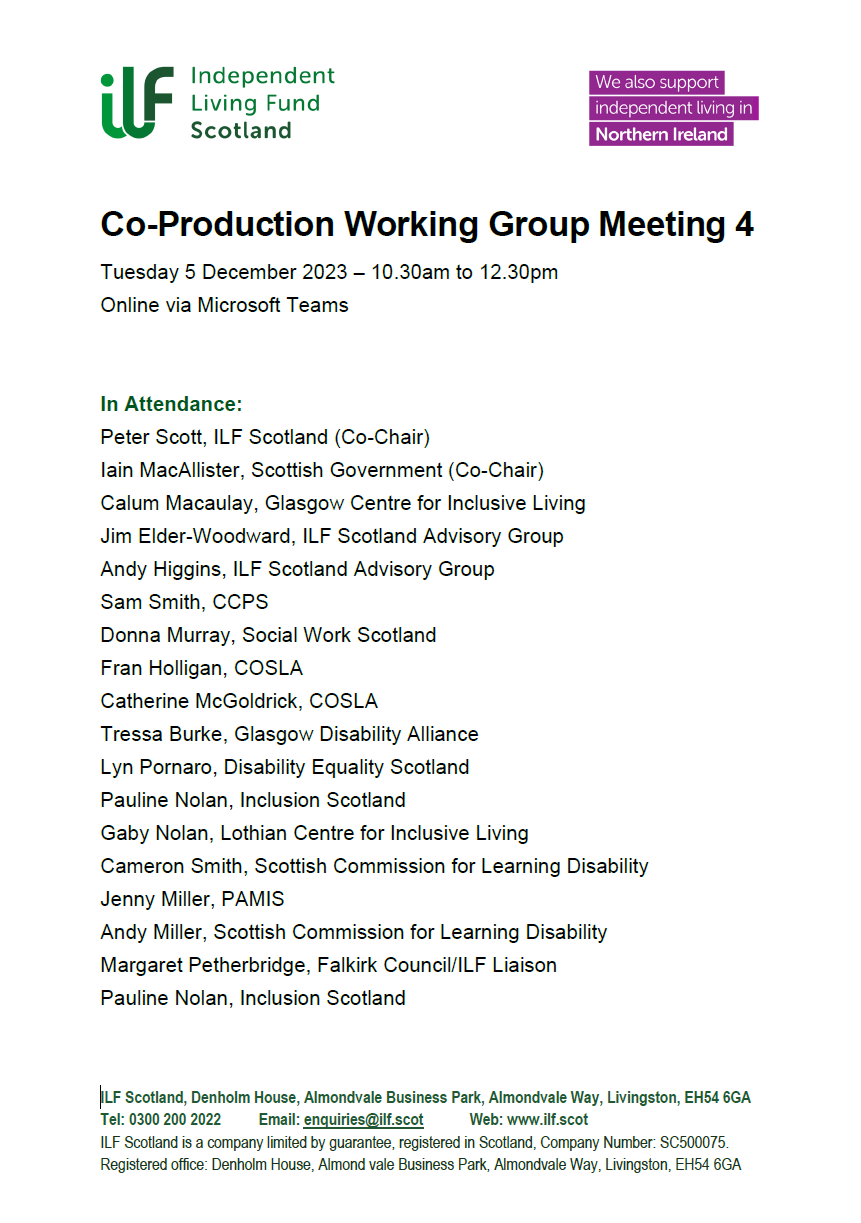

In Attendance:

Peter Scott, ILF Scotland (Co-Chair)

Iain MacAllister, Scottish Government (Co-Chair)

Calum Macaulay, Glasgow Centre for Inclusive Living

Jim Elder-Woodward, ILF Scotland Advisory Group

Andy Higgins, ILF Scotland Advisory Group

Sam Smith, CCPS

Donna Murray, Social Work Scotland

Fran Holligan, COSLA

Catherine McGoldrick, COSLA

Tressa Burke, Glasgow Disability Alliance

Lyn Pornaro, Disability Equality Scotland

Pauline Nolan, Inclusion Scotland

Gaby Nolan, Lothian Centre for Inclusive Living

Cameron Smith, Scottish Commission for Learning Disability

Jenny Miller, PAMIS

Andy Miller, Scottish Commission for Learning Disability

Margaret Petherbridge, Falkirk Council/ILF Liaison

Pauline Nolan, Inclusion Scotland

Present:

Robert Peterson, Scottish Government

Steven Hanlon, Scottish Government

Lauren Glen, Scottish Government

Jack Blaik, Scottish Government

Amelia Andrzejowska, Scottish Government

Robert White, ILF Scotland

Erika Mather, ILF Scotland

Linda Scott, ILF Scotland

Harvey Tilley – partially until 11:45am

Apologies Received:

Fiona Collie, Carers Scotland

Jan Savage and Oonagh Brow, Scottish Human Rights Commission

Donald Macleod, Self-Directed Support Scotland

Karen Lockhart, Glasgow City Council / ILF Liaison

Item 1: Welcome

The chair thanked all for attending the fourth meeting of the ILF Co-Production Working Group. Apologies were shared and Margaret Petherbridge was introduced.

Item 2: Declarations of Interest

None raised at this stage.

Item 3: Minutes of Previous Meeting

Minutes circulated in advance of this meeting. Request was noted to amend attendees list from last meeting. Otherwise, group was content to approve.

Item 4: Matters Arising and Actions

No actions recorded during last meeting.

Item 5: Co-Production Check In

Thanks were extended to Disability Equality Scotland for preparing the Easy Read versions of Papers. The group found the Easy Reads as well as Minutes very helpful in this fast-paced process, especially as they offer detailed information but in a clear and not over-complicated way.

Reassurance given that suggestions for improvement are welcomed at any stage.

Item 6: Available Income Charging

A short introduction of the topic provided with a brief history of charging in ILF and the current arrangement explained including recent reductions leading to current maximum charge of £43 a week, charging by deduction and relation to LAs charges. There is an opportunity while designing a new fund to make the scheme affordable without charges as we can set the award at the level that we know is affordable.

Group discussion included:

- It was pointed out that personal care is free so if charges are added they would be charged only for support other than personal care.

- Approximately 70% of ILF recipients are making an available income contribution.

- Practices of charging ILF Scotland recipients by LAs across Scotland were discussed and variances were indicated: some don’t charge anyone at all, some will not place a charge if ILF contribution is in place, some establish a joint charge by taking account of ILF charge and then LAs reduce the charge accordingly or vice versa; however, a few will not make any adjustments. Others work to minimise charges by application of a cap charge. It was reported that historically in some LAs people considered not applying for ILF because of charges. In many situations going forward ILF charges will not make any difference at all if LA charges already in place as they are most likely to be. Location determines who is paying charges or not and what effect it has.

- Some views were expressed that charges are seen as a care tax that should be scrapped altogether.

- It was indicated that ILF Advisory Group has been very vocal over the years in expressing the desire to remove Available Income Charges and voiced expectation that in due course we should abolish them in line with the existing commitment to remove all charges within the lifespan of this Parliament.

- It was pointed that the origins of the ILF charge are a bit different from LA charges: charges were based on the principle of not paying for the same outcome twice, through the ILF and the DLA care component. This concern is not relevant in the current ILF context.

- The question was asked how current ILF recipients would feel if new recipients won’t be charged in the re-opened fund whereas they are continued to be charged. However, it is difficult to say and there is no clear-cut answer especially given that even if ILF may not charge, LAs may continue to do so.

- Suggestion was made that we should focus on establishing principles to guide us if we can’t find an easy answer; it would be important to consider what the worst can happen with the decision we make. Is there any risk of ILF not being sustainable or people being worse off because of our decision? That consideration should inform our decision making. Principle applied by ILFS is always to ask what is in the best interest of the disabled person.

- It was emphasised that in the context of the cost-of-living crisis ILF Scotland is receiving more applications from recipients with requests to waive the charge due to financial hardship.

- It was explained that there is a joint commitment between COSLA and SG to work collaboratively towards removal of charges. There is an ongoing work on development of solutions to how income lost by LAs due removal can be replaced, and on the incorporation of research on the impact of unmet need. A sustainable approach in relation to broader removal of care charges is needed to ensure that there is no negative impact on other services. Additionally, ILF Scotland participates in COSLA charging guidance group and focuses on ensuing that unfairness is not created and people are not doubled charged.

- It was pointed that there will be other inequities among new and existing recipients e.g. maximum award or eligibility criteria. ILFS have an ambition to harmonise all differences, but it will not be from the first day. Important to recognise that there already many differences among ILF recipients.

- It was emphasised by some that in practical terms there is a high probability that for new applicants the charges established by LAs will be already in place.

- It may not make a big difference to many recipients at least at the early phase of the re-opened fund but important to remember that threshold supposed to be only an initial criterion. Hence, it is probable that once ILF evolves over time, the impact may be different.

- In terms operational impact, ILF Scotland can operate either way, with or without charges. But if charges are maintained it has some practical consequences on administration for ILF Scotland in relation to policy re data sharing and data collection in the re-opened fund.

- The group expressed general consensus that we should not have charges in the re-opened fund.

- The question was posed should the re-opened scheme have a capital limit? And if so on what basis? It was voiced that disabled people should have the same right to capital as any other person, and that penalising saving creates a barrier to saving for legitimate disability related costs. The capital limit is therefore a barrier to independence.

- The group agreed to recommend that the re-opened fund should not have a capital limit.

Item 7: Additionality of ILF

A short introduction to the topic was provided. Additionality refers to ILF funds enabling people to achieve independent living outcomes over and above LAs’ statutory duties. At the point of its closure in 2010, ILF UK had 5% of its recipients receiving more money from ILF than their LA. This rose to 25 % (i.e. 1 in 4 received more funding from ILF than LAs) by 2015, suggesting that additionality was eroded over time. It is understandable that LAs pursued this, as they were trying to maximise resources for as many people as they could. Since 2015, ILF Scotland has worked to rebalance awards to make sure ILF is not the main provider of funds. The figure is now around 10%.

The group’s discussion included:

- It was emphasised that comments and perspectives from group members with social work backgrounds are very important as the group attempts to find practical solutions despite the challenges faced by LAs.

- ILF Scotland does not operate in a vacuum, hence the interconnection with LAs and SDS assessment is crucial in ensuring that ILF does not offset LA cost. It was questioned whether it is realistic to ask not to treat ILF as an asset and not result in impact on SDS budget. It seems important that SDS budgets are maintained at the level recorded during application time and not to reduce it without prior negotiations with ILF Scotland.

- Suggestion was made to consider not allowing ILF monies to be spent on personal care. Important to keep in mind what is practical as this will be critical to how the fund is beneficial to recipients. If we are to move to a process that removes the threshold sum as the main access criteria, then the focus needs to be on personal outcomes and unmet need to allow for additionality to be meaningful.

- Should we agree that personal care is not to be funded in the re-opened fund? In practical terms it is often difficult to separate social care, personal care and independent living outcomes.

- It was said that while applying the asset strength-based approach during assessment, the whole life of the individual is being considered, including what other support is available to that person. Hence, ILF is also taken into consideration alongside networks, family and friends – this approach allows to identify where the gaps are – also, how unpaid carers can be supported – to enable them to continue to fulfil their responsibilities.

- It was noted that Social Workers (SWs) look at strengths and assets available to the person and what the person wants to achieve. There is a focus on ensuring choice and control of a disabled person and co-production of outcomes, and then conversations about budget follow.

- It was indicated that at the point of the application for the new fund the ILF will always additional as it was not there previously. However, on-going additionality is crucial and needs to be maintained and protected as it is known that in various authorities across the country budget and asset driven decisions are taken.

- ILF potential for preventing crisis could lead us to consider what priority groups can be considered to target support e.g. people returning home from hospital or those leaving institutions to return to their communities.

- It was raised that a variety of experiences are reported in regard to SDS. Often assessment is problematic in relation to person’s choice and control, not acknowledging the need for a collective assessment from a wider team including the expertise of family carers. Others pointed out that decisions are being made about use of SDS budgets by people who are not skilled in complex care.

- It was voiced that additionality means different things for different people in different areas and in different situations. It may mean personal care, but it can mean something else; it is challenging to distinguish what is personal care/social care/the need to meet basic needs. It was agreed that additionality should be re-defined especially considering that it can mean something different to me and you and defining it through personalised lens would be best.

- Everybody would agree on a strengths-based approach but impact on family members as unpaid carers to supplement the care package often creates burden to the whole family unit and we should not be dismissive of those pressures. Establishment of clear principles could assist to avoid distortions in the system.

- It was pointed that many of those issues should be viewed in the context of the reality of social care in Scotland – the broader landscape and challenges including serious staffing issues. Current financial challenges mean LAs need to make difficult decisions to focus on critical needs and prioritise crisis interventions. Furthermore, limited financial and human resources lead to huge reliance on community groups. There are amazing staff with a willingness to support people in a holistic way but the reality is that there are significant staffing and financial pressures.

- The group agreed to revisit additionality at a future meeting.

Item 8: Relationship with LAs

Not discussed due to time constraints. It was agreed to put on the agenda for the next meeting.

Item 9: AOB

Update provided that online engagement events were postponed. The event in Edinburgh at the Murrayfield will offer an opportunity for testing of the format and to learn and improve for the future events taking place in January.

Most likely another 3 to 4 meetings of the group expected in new year to finalise the recommendations. The future topics and the way of taking forward proposed changes are not confirmed yet at this stage.

Social return on investment research is being finalised and draft outcomes to be discussed at the next ILF Advisory Group meeting and then will be made available to SG and to wider public early in new year.

Item 10: Next Meeting Arrangements

It was proposed that the next meeting take place on 19 Dec and focus on Relationship with LAs and considering when is best to discuss summary of all the work completed so far to formulate the basis of what was agreed. It was indicated that we need to ensure time to get governance clearance from COSLA.